What is online survey research and when should we use it?

Online survey research provides quantitative measurements of customer attitudes, behaviors, and opinions through structured questionnaires delivered digitally. Surveys excel at collecting large amounts of data quickly and cost-effectively, enabling statistical analysis of trends and patterns. They work best for confirmatory research when you need to validate insights from other methods or measure specific metrics across broad populations.

Tip: Use surveys to quantify findings from qualitative research rather than as your only research method to ensure you capture both statistical significance and deeper insights.

How do surveys fit within the Experience Thinking framework?

Surveys measure customer perceptions across all four Experience Thinking areas - brand, content, product, and service experiences. We design surveys that capture how people feel about your brand personality, evaluate your content effectiveness, assess product usability, and rate service quality. This holistic approach ensures survey insights connect to your complete customer experience rather than isolated touchpoints.

Tip: Structure survey questions to examine experience connections between brand, content, product, and service rather than treating each area separately.

What advantages do online surveys offer over other research methods?

Online surveys enable rapid data collection from large, geographically distributed populations with relatively low cost per participant. They provide statistical reliability through large sample sizes, can be re-used over time to track trends, and allow participants to respond at their convenience. Surveys also eliminate interviewer bias and enable anonymous responses for sensitive topics.

Tip: Take advantage of survey scalability by including questions that track changes over time, creating longitudinal datasets that reveal customer attitude evolution.

What are the limitations of survey research we should understand?

Surveys capture what people say rather than what they actually do, and structured formats limit opportunities to probe deeper into responses or understand complex motivations. They work best for collecting attitudes and behaviors but lack the rich insights provided by observational methods. Survey responses can also be influenced by social desirability bias and recall limitations.

Tip: Combine surveys with observational methods like analytics or user testing to validate self-reported behaviors against actual behaviors.

How do you determine appropriate sample sizes for reliable survey results?

Sample size requirements depend on your population size, desired confidence level, and acceptable margin of error. We calculate sample sizes that ensure statistical significance while balancing research budget and timeline constraints. Proper sampling includes representing different customer segments and avoiding bias through random or stratified sampling approaches.

Tip: Prioritize representative sampling over large sample sizes - a smaller, well-balanced sample often provides more reliable insights than a large biased sample.

What's your approach to survey question design and testing?

Question design requires careful attention to wording, order, and response options to avoid leading participants or creating confusion. We use pre-testing with small groups to identify unclear questions, test survey flow, and estimate completion time. Question design includes both closed-ended questions for statistical analysis and strategic open-ended questions for qualitative insights.

Tip: Always pre-test your survey with a small group to identify confusing questions or technical issues before launching to your full audience.

How do you ensure survey research provides actionable business insights?

Actionable survey research starts with clear objectives tied to business decisions and includes questions that directly inform strategy choices. We design surveys that not only measure current attitudes but also reveal preferences, priorities, and decision-making factors that guide experience improvement decisions. Analysis focuses on patterns that lead to specific recommendations rather than just descriptive statistics.

Tip: Include priority ranking and trade-off questions in surveys to understand what improvements would have the most customer impact rather than just satisfaction ratings.

What's your approach to exploratory versus confirmatory survey research?

Exploratory surveys use more open-ended questions to discover new insights and identify unexpected patterns, while confirmatory surveys focus on validating specific hypotheses with structured questions that enable statistical analysis. Most effective survey research combines both approaches, using exploratory elements to uncover new insights and confirmatory elements to validate findings with larger populations.

Tip: Start with exploratory survey elements to identify unexpected insights, then use confirmatory questions to validate key findings with statistical confidence.

How do you design surveys that capture both attitudes and behaviors?

Attitude questions explore opinions, preferences, and perceptions, while behavioral questions focus on actual actions and usage patterns. We design surveys that capture both dimensions and examine alignment between what people say and what they do. This approach reveals gaps between intentions and actions that often indicate experience improvement opportunities.

Tip: Include both attitudinal and behavioral questions in surveys to identify disconnects between customer intentions and actual behaviors.

What's your approach to survey flow and participant experience design?

Survey design applies user experience principles to create engaging, easy-to-complete experiences that minimize abandonment and response bias. This includes logical question progression, clear instructions, progress indicators, and mobile-optimized formatting. We design surveys that respect participant time while gathering comprehensive insights.

Tip: Apply UX design principles to survey creation - clear navigation, logical flow, and mobile optimization improve completion rates and data quality.

How do you handle sensitive topics and encourage honest responses?

Sensitive topic research requires careful question positioning, anonymity assurance, and neutral wording that doesn't judge responses. We use indirect questioning techniques, offer 'prefer not to answer' options, and create psychological safety for honest feedback. Survey design includes introductions that explain confidentiality and the value of honest responses.

Tip: Position sensitive questions after rapport-building questions and clearly communicate anonymity and confidentiality to encourage honest responses.

What's your approach to demographic and segmentation data collection?

Demographic collection balances analytical needs with participant privacy concerns, gathering only information essential for segmentation analysis. We design demographic sections that feel relevant to survey topics and explain why information is needed. Segmentation planning determines which demographic factors are most important for understanding experience differences.

Tip: Collect demographic data that directly relates to your research objectives rather than standard demographic questions that might not be relevant to your customer experience goals.

How do you design survey questions that measure Experience Thinking areas effectively?

We create question sets that examine customer perceptions across brand, content, product, and service experiences, ensuring questions capture both individual area performance and cross-area connections. Question design includes rating scales, ranking exercises, and scenario-based questions that reveal how different experience areas influence overall customer relationships.

Tip: Include questions that examine experience connections between brand, content, product, and service areas rather than rating each area in isolation.

What's your approach to response scale design and bias reduction?

Response scale design affects data quality and analysis possibilities, requiring careful selection of scale types, neutral points, and anchoring that match question objectives. We use validated scales when available and design custom scales that avoid response bias through balanced wording and appropriate scale lengths that enable meaningful differentiation without overwhelming participants.

Tip: Choose response scales that match your analysis needs - use ranking questions for priority setting and rating scales for satisfaction measurement rather than applying the same scale type to all questions.

What's your approach to survey distribution and participant recruitment?

Distribution strategy balances reach with targeting, using multiple channels to ensure representative participation while avoiding survey fatigue. We help identify optimal timing, communication channels, and incentive structures that maximize response rates from your intended audience. Recruitment includes both existing customer outreach and external panel usage as needed.

Tip: Personalize survey invitations with relevant context about why participation matters to improve response rates and participant engagement.

How do you maximize survey response rates and completion quality?

Response optimization includes clear communication about survey purpose and length, mobile-friendly design, strategic timing, and appropriate incentives. We monitor completion patterns in real-time and adjust distribution strategies if response rates fall below targets. Quality assurance includes attention checks and response validation to ensure data reliability.

Tip: Communicate expected survey length and completion time upfront to set appropriate participant expectations and reduce abandonment rates.

What's your approach to survey timing and frequency optimization?

Timing optimization considers participant availability, survey topic relevance, and business decision timelines to maximize both response quality and strategic value. We help establish survey scheduling that avoids participant fatigue while providing timely insights for business planning. Frequency planning includes longitudinal studies that track changes without overwhelming audiences.

Tip: Consider your customer lifecycle timing when scheduling surveys - capture feedback when experiences are fresh in participant memory rather than long after interactions.

How do you handle survey data quality assurance and validation?

Data quality requires systematic validation including response time analysis, consistency checking, and attention verification throughout data collection. We monitor completion patterns, identify potential response bias, and apply quality filters that maintain data integrity without artificially excluding valid responses. Quality assurance includes both automated and manual review processes.

Tip: Include attention check questions strategically throughout longer surveys to identify low-quality responses without making the survey feel like a test.

What's your approach to survey accessibility and inclusion?

Accessible survey design ensures all intended participants can complete surveys regardless of technical abilities or disabilities. This includes screen reader compatibility, clear language, visual design considerations, and multiple completion options. Inclusion planning addresses language needs, cultural considerations, and technology access variations across your audience.

Tip: Test survey accessibility with assistive technologies and diverse user groups to ensure all intended participants can complete surveys successfully.

How do you manage survey project timelines and deliverable expectations?

Timeline management includes survey design, testing, distribution, data collection, analysis, and reporting phases with realistic estimates for each stage. We provide clear milestone communication and adjust timelines based on response rate patterns while maintaining data quality standards. Project management includes both technical execution and stakeholder communication throughout the process.

Tip: Build buffer time into survey project timelines for potential response rate challenges or data quality issues that might require additional data collection.

What technology platforms and tools do you use for survey delivery?

Platform selection balances functionality needs with participant experience, choosing tools that support complex question logic while maintaining ease of use. We select platforms based on survey complexity, audience characteristics, and integration requirements with your existing systems. Technology considerations include mobile optimization, security, and data export capabilities.

Tip: Choose survey platforms based on your audience's technology preferences and capabilities rather than just feature sophistication to ensure maximum participation.

What's your approach to statistical analysis and data interpretation?

Statistical analysis includes descriptive statistics, correlation analysis, and significance testing that reveal patterns and relationships in survey data. We combine statistical rigor with business context interpretation, translating statistical findings into actionable insights that inform experience strategy decisions. Analysis includes both overall trends and segment-specific patterns.

Tip: Focus statistical analysis on business-relevant patterns and relationships rather than every possible statistical test to ensure insights remain actionable and clear.

How do you identify and analyze customer segments within survey data?

Segmentation analysis reveals distinct customer groups based on attitudes, behaviors, preferences, and demographic characteristics that affect experience needs. We use statistical clustering techniques combined with business knowledge to identify meaningful segments that inform experience personalization strategies. Segment analysis examines both differences and similarities across groups.

Tip: Create customer segments based on experience-relevant characteristics rather than just demographic differences to inform more effective experience personalization strategies.

What's your approach to trend analysis and longitudinal survey studies?

Longitudinal analysis tracks changes in customer attitudes and behaviors over time, revealing evolving expectations and experience effectiveness. We design survey programs that enable trend analysis through consistent question tracking while allowing for questionnaire evolution as business needs change. Trend analysis identifies both gradual shifts and sudden changes in customer perceptions.

Tip: Maintain core tracking questions across survey waves while allowing flexibility for new questions to ensure both trend analysis and evolving business insight needs.

How do you analyze open-ended survey responses for deeper insights?

Open-ended response analysis combines qualitative coding techniques with quantitative frequency analysis to identify themes, sentiment patterns, and specific improvement suggestions. We use systematic categorization approaches that reveal both common themes and unique insights that might inform innovation opportunities. Analysis includes both content themes and emotional tone assessment.

Tip: Include strategic open-ended questions in surveys to capture unexpected insights and specific suggestions that structured questions might miss.

What's your approach to cross-tabulation and relationship analysis?

Cross-tabulation reveals relationships between different survey variables, showing how demographics, behaviors, and attitudes interact to influence customer experience perceptions. We examine correlations between satisfaction ratings and specific experience factors to identify what drives positive customer relationships. Relationship analysis informs priority setting for experience improvements.

Tip: Use cross-tabulation to identify which customer characteristics most strongly predict satisfaction or loyalty rather than just reporting average satisfaction scores.

How do you handle incomplete responses and missing data in analysis?

Missing data analysis examines patterns of incomplete responses to understand whether missing data is random or systematic, applying appropriate statistical techniques to handle gaps without introducing bias. We analyze partial completions to understand survey abandonment points and adjust future survey design to improve completion rates while maintaining analytical integrity.

Tip: Analyze survey abandonment patterns to identify question types or survey sections that cause participant drop-off for future survey design improvement.

What's your approach to survey data visualization and pattern identification?

Data visualization transforms statistical findings into clear, actionable insights through charts, graphs, and dashboards that highlight key patterns and relationships. We create visualizations that reveal customer segment differences, trend patterns, and priority areas for experience improvement. Visualization design focuses on business decision support rather than just data presentation.

Tip: Create data visualizations that directly support business decisions rather than just displaying survey results to ensure insights lead to action.

How do you use surveys to measure customer experience across the complete lifecycle?

Lifecycle survey research examines customer experience from initial awareness through advocacy, measuring satisfaction, effort, and emotional engagement at key journey stages. Using Experience Thinking principles, we design survey approaches that capture how brand, content, product, and service experiences connect throughout the customer relationship rather than measuring isolated interactions.

Tip: Map survey questions to specific customer lifecycle stages to understand how experience quality affects progression from customer to user to advocate.

What's your approach to brand perception and positioning survey research?

Brand survey research measures brand awareness, perception, differentiation, and emotional connection using both direct questions and projective techniques. We examine how customers perceive brand personality traits, competitive positioning, and brand promise delivery. Brand surveys often include image association exercises and competitive comparison questions that reveal positioning opportunities.

Tip: Include indirect brand perception questions like personality associations and competitive comparisons rather than just direct brand rating questions to capture subconscious perceptions.

How do you design surveys to measure content effectiveness and engagement?

Content survey research evaluates information usefulness, findability, clarity, and engagement across different content types and channels. We measure how well content supports customer goals, identify content gaps, and assess content quality perceptions. Content surveys often include task-based scenarios that reveal content performance in realistic usage contexts.

Tip: Design content survey questions around specific customer tasks and goals rather than general content satisfaction to understand functional content effectiveness.

What's your approach to product experience and usability survey research?

Product surveys measure usability perceptions, feature satisfaction, and overall product experience quality through structured questionnaires that complement observational usability testing. We examine perceived ease of use, usefulness, and satisfaction while identifying specific areas for product improvement. Product surveys often follow actual product usage to capture authentic experience feedback.

Tip: Administer product surveys after actual usage experiences rather than relying on memory or hypothetical scenarios to capture accurate usability perceptions.

How do you use surveys to measure service experience quality and satisfaction?

Service surveys capture customer perceptions of service delivery across multiple touchpoints including support interactions, self-service tools, and relationship management. We measure service quality dimensions like responsiveness, reliability, empathy, and problem resolution effectiveness. Service surveys often include critical incident analysis that identifies specific service moments that drive satisfaction or dissatisfaction.

Tip: Include service experience surveys at multiple touchpoints rather than just after support interactions to understand complete service relationship quality.

What's your approach to competitive analysis through survey research?

Competitive survey research compares customer perceptions of your organization against competitors across experience dimensions, revealing competitive strengths and vulnerabilities. We design comparative questions that capture relative performance and switching considerations. Competitive analysis includes both direct competitors and alternative solutions that customers consider.

Tip: Include indirect competitors and alternative solutions in competitive survey research rather than just direct competitors to understand broader customer choice considerations.

How do you design surveys for customer segmentation and persona development?

Segmentation surveys capture attitudes, behaviors, preferences, and demographic characteristics that differentiate customer groups with distinct experience needs. We design questions that reveal both obvious differences and subtle distinctions that affect experience design. Segmentation surveys often include lifestyle, values, and preference questions that go beyond basic demographics.

Tip: Include psychographic and behavioral questions in segmentation surveys rather than just demographics to create more meaningful customer segments for experience design.

How do you integrate survey research with other research methods?

Survey integration amplifies insights from qualitative methods like interviews and observations by validating findings with larger populations and measuring prevalence of discovered patterns. We use surveys to confirm qualitative insights, prioritize improvement opportunities, and track changes over time. Integration includes both sequential and concurrent mixed-method approaches that maximize insight value.

Tip: Use surveys to quantify and validate insights discovered through qualitative research rather than treating different research methods as separate activities.

What's your approach to combining surveys with analytics and behavioral data?

Combining self-reported survey data with actual behavioral analytics reveals gaps between what customers say and what they do, providing complete understanding of customer experience. We correlate survey responses with usage patterns, conversion data, and engagement metrics to validate perceptions against actual behaviors. This integration identifies where experiences need improvement.

Tip: Match survey participants with their actual behavioral data when possible to identify disconnects between perceived and actual experience quality.

How do you use surveys to validate insights from ethnographic and observational research?

Surveys test whether insights discovered through observational research apply to broader customer populations, measuring the prevalence of behaviors and attitudes identified through ethnographic studies. We design validation questions that confirm observational findings while exploring variations across different customer segments and contexts.

Tip: Design survey validation questions that test specific observational insights rather than general topics to ensure ethnographic findings apply to your broader customer population.

What's your approach to survey-supported journey mapping and experience design?

Surveys provide quantitative validation for journey maps created through qualitative research, measuring satisfaction and effort at each journey stage while identifying critical moments that most influence overall experience quality. Survey data helps prioritize journey improvements and track journey optimization effectiveness over time through systematic measurement.

Tip: Use surveys to quantify emotional highs and lows identified in qualitative journey mapping to prioritize which journey moments most need improvement attention.

How do you integrate survey research with usability testing and user research?

Survey research complements usability testing by measuring perceptions and attitudes that extend beyond task completion, capturing emotional responses and overall experience quality that observational testing might miss. We use post-testing surveys to understand participant reactions and broader surveys to validate usability findings across larger populations.

Tip: Include brief surveys after usability testing sessions to capture participant emotions and overall impressions that observation alone might miss.

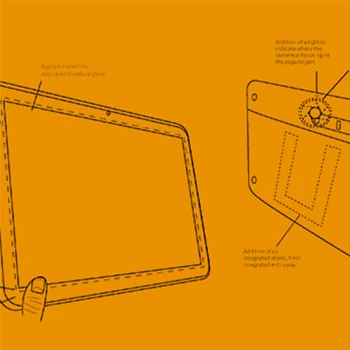

What's your approach to survey research in design validation and concept testing?

Concept testing surveys measure customer response to new ideas, designs, and experience approaches before implementation investment. We design surveys that capture both rational evaluation and emotional response to concepts, including preference ranking and trade-off analysis that inform design decisions. Concept testing includes both isolated concept evaluation and competitive comparison.

Tip: Include emotional response questions in concept testing surveys alongside rational evaluation to understand complete customer reaction to new design concepts.

How do you use survey research to support A/B testing and optimization programs?

Surveys provide context for A/B testing results by explaining why certain designs perform better and revealing customer preferences that guide future optimization decisions. We use surveys to understand customer motivations behind behavioral patterns observed in A/B tests. Survey research helps identify what to test and explains testing results.

Tip: Use surveys to understand customer motivations behind A/B testing results rather than just measuring which option performs better to inform future optimization decisions.

How do you integrate AI and automation into survey research processes?

AI enhances survey research through automated response analysis, pattern identification, and real-time survey optimization that adapts questions based on participant responses. We use AI for sentiment analysis of open-ended responses, predictive modeling of customer behavior, and survey personalization that improves relevance. AI augments human analysis rather than replacing strategic interpretation and ensures ethical data usage throughout research processes.

Tip: Start AI integration with response analysis and pattern identification rather than survey design to build confidence in AI capabilities before automating critical research decisions.

What's your approach to mobile-optimized survey research?

Mobile optimization includes responsive design, touch-friendly interfaces, and question formats that work effectively on small screens. We adapt question types, reduce visual complexity, and optimize completion flow for mobile users while maintaining survey objectives. Mobile considerations include data usage awareness and completion context flexibility for various mobile usage scenarios.

Tip: Design mobile surveys with shorter question sets and simpler interaction patterns rather than just shrinking desktop surveys to fit mobile screens.

How do you handle international and multi-cultural survey research?

International survey research requires cultural adaptation that goes beyond translation, including question concepts, response styles, and cultural communication patterns that affect data quality. We adapt survey approaches for different cultural contexts while maintaining data comparability across regions. International considerations include local research regulations and privacy requirements.

Tip: Include cultural consultants in international survey design rather than just translating existing surveys to ensure questions are culturally appropriate and meaningful.

What's your approach to longitudinal and panel survey research?

Longitudinal research tracks the same participants over time to understand how customer attitudes and experiences evolve, revealing trends and changes that cross-sectional surveys miss. We design panel management approaches that maintain participant engagement while tracking meaningful changes. Longitudinal analysis identifies both individual customer evolution and broader market trends.

Tip: Design longitudinal survey programs with core tracking questions and flexible modules rather than identical surveys to maintain trend analysis while adapting to evolving research needs.

How do you conduct pulse surveys for continuous experience monitoring?

Pulse surveys provide regular, brief measurement of key experience indicators through short, focused questionnaires that track changes without creating survey fatigue. We design pulse survey programs that balance measurement frequency with participant burden, focusing on leading indicators that predict experience trends. Pulse surveys enable rapid response to experience changes.

Tip: Keep pulse surveys focused on a few critical metrics rather than trying to measure everything to maintain high response rates and participant engagement over time.

What's your approach to voice of customer and feedback integration surveys?

Voice of customer surveys systematically capture and analyze customer feedback across all touchpoints, integrating structured survey data with unstructured feedback from support interactions, social media, and review platforms. We create feedback integration approaches that provide holistic customer voice analysis rather than siloed feedback management.

Tip: Create systematic approaches for integrating survey feedback with other customer voice sources rather than analyzing survey data in isolation from other feedback channels.

How do you use surveys for innovation research and future opportunity identification?

Innovation surveys explore customer unmet needs, future preferences, and reactions to new concepts using foresight design principles that anticipate changing customer expectations. We design forward-looking survey questions that reveal opportunity areas and test innovative concepts. Innovation research includes both current need analysis and future scenario exploration.

Tip: Include future scenario and unmet need questions in innovation surveys rather than just current satisfaction measurement to identify opportunity areas for experience innovation.

What's your approach to survey reporting and insight communication?

Survey reporting translates statistical findings into strategic insights through clear data visualization, executive summaries, and actionable recommendations that connect to business objectives. We create different report formats for different stakeholders, ensuring each audience receives relevant insights in appropriate detail. Reporting focuses on decisions and actions rather than just data presentation.

Tip: Create different report versions for different stakeholder groups rather than one-size-fits-all reporting to ensure each audience gets relevant insights in appropriate detail.

How do you present survey findings to support business decision-making?

Decision support requires connecting survey insights to specific business choices, presenting findings with clear implications for strategy, operations, and investment priorities. We create recommendation frameworks that link customer feedback to business actions, including priority rankings and implementation guidance that help stakeholders act on insights effectively.

Tip: Structure survey presentations around business decisions that need to be made rather than just survey results to ensure insights drive action.

What's your approach to survey dashboard and ongoing monitoring systems?

Dashboard development creates real-time visibility into key survey metrics through automated data visualization that enables continuous monitoring of customer experience indicators. We design dashboard systems that alert stakeholders to significant changes while providing drill-down capabilities for detailed analysis. Monitoring systems balance automation with human interpretation.

Tip: Design survey dashboards around actionable metrics and alert thresholds rather than just displaying all available data to focus attention on changes that need response.

How do you handle survey insight distribution and organizational communication?

Insight distribution ensures survey findings reach relevant stakeholders through appropriate communication channels and formats that encourage action rather than just awareness. We create communication strategies that share insights across organizational levels and functions, adapting message content and format for different audience needs and decision-making authority.

Tip: Create insight distribution plans that specify who needs what information for decision-making rather than sharing all findings with everyone to ensure relevant insights reach appropriate stakeholders.

What's your approach to survey research storytelling and narrative development?

Research storytelling transforms survey data into compelling narratives that help stakeholders understand customer perspectives and motivate action around experience improvements. We create customer stories based on survey insights that make statistical findings human and relatable. Storytelling includes both individual customer examples and aggregate pattern narratives.

Tip: Combine statistical survey findings with customer stories and examples to make data more compelling and memorable for stakeholders.

How do you provide survey research training and capability building?

Research capability building includes training in survey design, analysis, and interpretation that enables your organization to conduct effective survey research independently. We provide methodology education, tool training, and ongoing consultation that builds internal research capabilities while maintaining quality standards. Training includes both technical skills and strategic thinking development.

Tip: Include hands-on survey project experience in research training rather than just theoretical education to build practical capabilities for real research challenges.

What's your approach to survey research documentation and knowledge management?

Research documentation captures methodology decisions, findings, and lessons learned that inform future survey research and enable organizational learning. We create research repositories that preserve survey designs, analysis approaches, and insights for reference in subsequent research projects. Documentation includes both technical methods and strategic insights.

Tip: Create systematic documentation of survey research methods and insights to build organizational research knowledge rather than starting from scratch with each new survey project.

What's your collaborative approach to survey research planning and design?

Collaborative survey design includes stakeholder workshops, objective setting sessions, and iterative question development that ensures research addresses real business needs while maintaining methodological rigor. We combine client business knowledge with research expertise to create surveys that provide strategic value. Collaboration includes both research design and insight interpretation phases.

Tip: Include diverse internal stakeholders in survey planning to ensure research objectives address multiple business perspectives and decision-making needs.

How do you ensure survey research aligns with organizational goals and constraints?

Research alignment requires understanding business objectives, timeline constraints, and resource limitations that affect survey design and implementation. We adapt research approaches to fit organizational context while maintaining quality standards. Alignment includes both strategic objective matching and practical implementation consideration that ensures research success.

Tip: Clearly communicate business constraints and priorities during survey planning to ensure research design balances ideal methodology with practical implementation needs.

What's your approach to survey research project management and communication?

Project management includes timeline coordination, stakeholder communication, and progress monitoring that ensures survey research delivers insights when needed for business decision-making. We provide regular updates, milestone communication, and proactive issue resolution that keeps projects on track while maintaining quality standards.

Tip: Establish clear communication schedules and milestone checkpoints for survey projects rather than waiting until completion to share progress updates.

How do you provide ongoing support after survey research completion?

Post-research support includes insight interpretation assistance, implementation guidance, and follow-up consultation that helps organizations act on survey findings effectively. We provide strategic guidance for applying insights, methodology consultation for future research, and success tracking that measures the impact of research-informed decisions.

Tip: Include post-research consultation in survey project planning to ensure insights lead to action rather than just adding to organizational knowledge.

What's your approach to survey research quality assurance and validation?

Quality assurance includes methodology review, data validation, and insight verification that ensures research findings are reliable and actionable. We use systematic quality checks throughout the research process, from survey design validation through data analysis verification. Quality assurance includes both technical rigor and strategic relevance validation.

Tip: Include independent quality review of survey methodology and analysis rather than relying solely on internal validation to ensure research quality and credibility.

How do you measure the business impact and value of survey research investments?

Impact measurement tracks how survey insights influence business decisions and outcomes, measuring both direct research application and broader organizational learning that results from research programs. We help establish metrics that connect research investments to business results while recognizing that research value often extends beyond immediate decision support.

Tip: Track both direct research application and broader organizational decision-making improvements to understand complete value of survey research investments.

What's your approach to building long-term survey research capabilities and partnerships?

Long-term capability building focuses on developing organizational research skills, establishing systematic survey programs, and creating research cultures that use customer insights effectively. We provide ongoing consultation, methodology development, and strategic guidance that builds sustainable research capabilities rather than project-based dependencies.

Tip: Focus long-term research partnerships on capability building and organizational learning rather than just research execution to create sustainable competitive advantages through customer insight.