What is focus group research and when should we use it?

Focus group research explores the emotions, opinions, and motivations that drive customer decisions through guided discussions with 6-10 representative participants. Focus groups excel at revealing how people feel about concepts, uncovering social dynamics around brand perceptions, and gathering initial attitudes that guide further research. They work best for early-stage exploration, concept testing, and understanding the 'why' behind customer attitudes.

Tip: Use focus groups for exploratory research and concept validation rather than detailed usability evaluation to align methodology with your research objectives.

How do focus groups fit within the Experience Thinking framework?

Focus groups reveal customer emotions and perceptions across all four Experience Thinking areas - brand, content, product, and service experiences. We design focus group discussions that explore how people feel about your brand personality, evaluate your content relevance, assess product concepts, and discuss service expectations. This holistic approach ensures focus group insights connect to your complete customer experience rather than isolated touchpoints.

Tip: Structure focus group discussions around Experience Thinking areas to understand how brand, content, product, and service perceptions influence overall customer relationships.

What advantages do focus groups offer over other research methods?

Focus groups provide rapid insight collection from multiple participants simultaneously, revealing group dynamics and social influences that individual interviews miss. They excel at exploring emotional responses, generating ideas through group interaction, and uncovering language that customers use naturally. Focus groups also enable real-time concept testing and immediate follow-up questions based on participant reactions.

Tip: Leverage focus group social dynamics to understand how customers influence each other's perceptions and decisions about your brand or products.

What are the limitations of focus group research we should understand?

Focus groups can be influenced by dominant personalities, group consensus pressure, and social desirability bias that may not reflect individual opinions. They cannot explore actual usage behaviors or test detailed usability, and results cannot be statistically extrapolated to broader populations. Focus groups work best as exploratory research that guides further investigation rather than final answers.

Tip: Plan focus groups as part of a broader research approach that includes individual interviews or quantitative validation rather than relying solely on group feedback.

How do you determine appropriate focus group size and composition?

Group size typically ranges from 6-10 participants to ensure everyone can contribute while maintaining manageable discussion flow. Composition balances demographic diversity with shared experience relevance to your research objectives. We consider personality dynamics, domain knowledge levels, and communication styles to create groups that generate productive discussion rather than dominance or silence.

Tip: Include mix of personality types in focus groups rather than just demographics to ensure diverse perspectives and avoid groupthink dynamics.

What's your approach to focus group participant recruitment and screening?

Participant recruitment involves careful screening to ensure participants represent your target audience while avoiding professional focus group participants who may provide biased feedback. We balance demographic representation with behavioral characteristics relevant to your research objectives. Screening includes both qualification criteria and disqualification factors that ensure authentic customer perspectives.

Tip: Screen out professional focus group participants who may provide rehearsed responses rather than authentic customer perspectives.

How do focus groups work for different stages of product and service development?

Early-stage focus groups explore customer needs, concept appeal, and market opportunities using low-fidelity prototypes and scenarios. Development-stage groups test specific features, messaging, and positioning approaches. Launch-stage groups evaluate marketing concepts and value propositions. Each stage requires different discussion approaches and materials that match development objectives.

Tip: Match focus group methodology and materials to your development stage rather than using the same approach throughout product development.

What's your approach to skilled focus group moderation?

Skilled moderation establishes positive group dynamics while gathering diverse opinions through structured facilitation that prevents dominant personalities from controlling discussions. Our moderators use probing techniques, redirecting strategies, and inclusive facilitation that ensures all participants contribute meaningful insights. Moderation balances structure with flexibility to explore unexpected insights that emerge during discussions.

Tip: Invest in experienced moderators who can manage group dynamics and prevent consensus bias rather than just following discussion guides.

How do you handle dominant personalities and encourage balanced participation?

Managing dominant participants involves redirecting techniques, direct invitation to quieter participants, and structured exercises that ensure everyone contributes. We use round-robin discussions, written exercises before verbal sharing, and small group breakouts that create multiple opportunities for participation. Moderation includes both inclusion strategies and gentle dominance management.

Tip: Include structured exercises and individual reflection time in focus groups to ensure quieter participants can contribute before group dynamics take over.

What's your approach to avoiding leading questions and confirmation bias?

Unbiased moderation uses open-ended questions, neutral wording, and exploratory techniques that allow participants to express authentic opinions rather than confirming moderator assumptions. We avoid leading language, provide multiple response opportunities, and use projective techniques that reveal underlying attitudes. Moderation training includes bias recognition and neutral facilitation skills.

Tip: Train moderators to ask 'what would you expect?' rather than 'does this make sense?' to capture authentic participant predictions rather than confirmation responses.

How do you create safe spaces for honest feedback in group settings?

Safe space creation involves establishing ground rules, ensuring confidentiality, and modeling respectful disagreement that encourages diverse opinions. We create psychological safety through inclusive language, validation of different perspectives, and structured sharing that reduces judgment risk. Environment design includes both physical comfort and emotional safety considerations.

Tip: Establish clear ground rules about respecting different opinions at the beginning of focus groups to create psychological safety for honest feedback.

What's your approach to managing cultural differences and diverse perspectives?

Cultural sensitivity requires understanding communication styles, authority relationships, and expression patterns that vary across cultural backgrounds. We adapt moderation approaches to encourage participation from different cultural perspectives while maintaining research objectives. Diverse group management includes both cultural awareness and inclusive facilitation techniques.

Tip: Include cultural consultants in focus group planning for diverse audiences rather than assuming universal communication approaches work across all cultural groups.

How do you handle emotional responses and sensitive topics in focus groups?

Emotional topic management involves preparation for strong reactions, supportive facilitation during difficult discussions, and appropriate follow-up for participants who become upset. We create protocols for managing emotions while maintaining research objectives, including when to pause discussions and how to provide participant support. Sensitive topic research includes both preparation and real-time response strategies.

Tip: Prepare moderation protocols for emotional responses and sensitive topics rather than hoping they won't arise during focus group discussions.

What's your approach to focus group timing and energy management?

Energy management involves structuring discussions to maintain engagement throughout sessions, using variety in exercises and discussion formats to prevent fatigue. We design session flow that balances focused discussion with interactive exercises, ensuring productive participation throughout the entire session. Timing includes both overall session length and internal pacing considerations.

Tip: Design focus group sessions with varied activities and natural energy breaks rather than continuous discussion to maintain participant engagement throughout longer sessions.

What's your approach to exploratory versus confirmatory focus group research?

Exploratory focus groups use open-ended discussions to discover new insights and understand complex attitudes through unstructured exploration that follows participant interests. Confirmatory groups test specific hypotheses and concepts through structured discussions that validate insights from other research. Most effective focus group research combines both approaches within discussion flow.

Tip: Begin focus groups with exploratory discussion before introducing specific concepts to capture unbiased initial reactions and unexpected insights.

How do you design focus group discussions around brand and positioning research?

Brand focus groups explore emotional connections, personality perceptions, and competitive positioning through exercises like brand personification, association mapping, and scenario discussions. Using Experience Thinking principles, we examine how brand perceptions influence content, product, and service expectations. Brand discussions include both rational evaluation and emotional response exploration.

Tip: Use projective techniques like brand personification in focus groups to reveal deeper emotional associations that participants might not express directly.

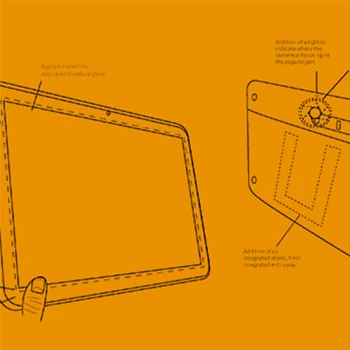

What's your approach to concept testing and innovation research in focus groups?

Concept testing involves presenting early-stage ideas through sketches, storyboards, or prototypes that convey concept essence without detailed implementation. We gather feedback on appeal, comprehension, and improvement suggestions while maintaining concept simplicity to avoid biased reactions. Innovation research explores both concept evaluation and generation of new ideas through group creativity.

Tip: Keep concept presentations simple and low-fidelity in focus groups to avoid participants reacting to polish rather than core concept value.

How do you use focus groups to explore customer journey experiences?

Journey-focused discussions explore customer experiences across touchpoints, revealing emotional highs and lows, pain points, and moments of delight through narrative techniques and experience mapping exercises. We examine how customers move between awareness, consideration, usage, and advocacy stages, understanding motivations and barriers at each phase. Journey discussions connect individual touchpoints to overall relationship quality.

Tip: Use storytelling techniques in journey-focused focus groups to help participants reconstruct actual experiences rather than general opinions about your organization.

What's your approach to service experience and process improvement focus groups?

Service focus groups examine customer interactions across multiple touchpoints, exploring service delivery effectiveness, staff interaction quality, and process efficiency from customer perspectives. We use scenario discussions, role-playing exercises, and process mapping that reveal service gaps and improvement opportunities. Service research includes both current experience evaluation and ideal experience exploration.

Tip: Include service delivery scenarios in focus groups to understand customer expectations and preferences for different service interaction approaches.

How do you design focus groups for competitive analysis and market positioning?

Competitive research explores how customers perceive your organization relative to alternatives, examining decision-making factors, switching considerations, and competitive advantages through comparative exercises and scenario discussions. We explore both direct competitors and alternative solutions that customers consider, understanding choice criteria and loyalty factors.

Tip: Include indirect competitors and alternative solutions in competitive focus groups rather than just direct competitors to understand broader customer choice considerations.

What's your approach to content and communication testing in focus groups?

Content focus groups evaluate message clarity, emotional resonance, and comprehension through discussion of marketing materials, website content, and communication approaches. We test language preferences, information priorities, and content effectiveness through both structured feedback and natural conversation analysis. Content testing includes both individual content pieces and integrated communication strategies.

Tip: Test content concepts and language in focus groups before final production to identify unclear messaging or unintended emotional responses.

How do you prevent and manage groupthink in focus group discussions?

Groupthink prevention involves moderation techniques that encourage individual opinions before group discussion, use anonymous input methods, and actively seek dissenting views. We structure discussions to gather individual perspectives first, then explore group dynamics while maintaining opinion diversity. Groupthink management includes recognizing consensus pressure and intervening to maintain authentic feedback.

Tip: Start focus group topics with individual written responses before group discussion to prevent early consensus from influencing authentic individual opinions.

What's your approach to managing confirmation bias in focus group research?

Confirmation bias management involves designing discussions that actively seek disconfirming evidence and alternative perspectives rather than just supporting existing assumptions. We train moderators to probe negative feedback, explore contradictory opinions, and ask follow-up questions that challenge initial responses. Bias reduction includes both moderation techniques and analysis approaches that consider contradictory evidence.

Tip: Actively probe for negative feedback and alternative viewpoints in focus groups rather than accepting initial positive responses as complete customer perspectives.

How do you address social desirability bias in group settings?

Social desirability management involves creating acceptance for diverse opinions, using indirect questioning techniques, and providing anonymous input opportunities that reduce pressure to give socially acceptable answers. We design exercises that normalize different perspectives and reduce judgment pressure. Bias management includes both environmental design and facilitation approaches.

Tip: Include anonymous input methods in focus groups to capture opinions that participants might not express verbally due to social pressure.

What's your approach to hindsight bias recognition and prevention?

Hindsight bias occurs when participants claim they 'knew all along' what the best solution would be after seeing research results. We prevent this by having participants predict outcomes before revealing information and explain their reasoning. Bias prevention includes structuring discussions to capture authentic predictions rather than post-hoc explanations.

Tip: Ask focus group participants to predict outcomes before revealing information rather than asking if revealed information 'makes sense' to capture authentic expectations.

How do you handle survivorship bias in focus group recruitment?

Survivorship bias occurs when research only includes current customers while ignoring former customers who left, creating incomplete understanding of customer experience. We include both current and former customers in research design, examining both success stories and failure experiences. Recruitment strategies actively seek diverse experience perspectives rather than just satisfied current customers.

Tip: Include former customers and non-users in focus group recruitment rather than just current satisfied customers to understand complete experience spectrum.

What's your approach to moderator bias awareness and training?

Moderator bias training includes awareness of personal assumptions, leading question recognition, and neutral facilitation techniques that prevent moderator opinions from influencing participant responses. We provide moderator support in bias recognition, neutral probing, and balanced perspective gathering that maintains research integrity. Bias management includes both preparation and real-time self-monitoring.

Tip: Include regular bias awareness training for focus group moderators rather than assuming experienced facilitators are automatically bias-free.

How do you validate focus group findings against other data sources?

Validation involves comparing focus group insights with survey data, analytics, and individual interviews to identify consistent patterns and contradictory findings that warrant further investigation. We use triangulation approaches that strengthen confidence in insights while identifying areas where group dynamics might have influenced responses. Validation includes both statistical and qualitative confirmation methods.

Tip: Plan validation studies that test focus group insights with other research methods rather than treating group discussions as final answers to research questions.

How do you use focus groups for brand experience and positioning research?

Brand focus groups explore emotional connections, competitive positioning, and brand personality perceptions through personification exercises, association mapping, and positioning discussions. Using Experience Thinking principles, we examine how brand perceptions influence expectations across content, product, and service experiences. Brand research includes both current perception evaluation and positioning concept testing.

Tip: Include brand personification exercises in focus groups to reveal emotional associations and personality perceptions that direct questioning might miss.

What's your approach to innovation and opportunity discovery through focus groups?

Innovation focus groups explore unmet needs, future preferences, and reaction to new concepts using foresight design principles that anticipate changing customer expectations. We facilitate creative exercises, scenario exploration, and ideation sessions that reveal opportunity areas beyond current experience improvements. Innovation research includes both need identification and solution concept generation.

Tip: Include future scenario discussions in innovation focus groups to understand how changing conditions might affect customer needs and preferences.

How do you design focus groups for customer segmentation and persona development?

Segmentation focus groups reveal attitude and behavior differences across customer groups through comparative discussion approaches that explore varied perspectives, motivations, and preferences. We design group composition that represents different segments while examining both similarities and differences in customer experience needs. Segmentation research includes both demographic and psychographic exploration.

Tip: Conduct separate focus groups for different customer segments rather than mixing segments in single groups to understand distinct perspective differences clearly.

What's your approach to messaging and communication testing in focus groups?

Communication testing explores message clarity, emotional resonance, and comprehension through discussion of marketing materials, value propositions, and communication approaches. We test language preferences, information priorities, and message effectiveness through both structured feedback and natural conversation analysis. Communication research includes both individual message testing and integrated campaign evaluation.

Tip: Test communication concepts at multiple complexity levels in focus groups to understand what resonates with different audience knowledge levels.

How do you use focus groups for competitive intelligence and market research?

Competitive research examines customer perceptions of your organization versus alternatives through comparative exercises, switching scenario discussions, and competitive advantage exploration. We explore decision-making factors, loyalty drivers, and competitive differentiation through structured comparison activities. Market research includes both direct competitor analysis and broader market opportunity exploration.

Tip: Include competitive switching scenarios in focus groups to understand what would motivate customers to change loyalties rather than just rating current competitors.

What's your approach to crisis communication and reputation management focus groups?

Crisis research explores customer reactions to challenging situations, communication preferences during difficulties, and recovery expectations through scenario-based discussions and reputation impact assessment. We examine both immediate crisis response and long-term relationship recovery strategies. Crisis focus groups include both current perception evaluation and recovery approach testing.

Tip: Include crisis scenario planning in focus groups before actual crises occur to understand customer expectations and develop prepared response strategies.

How do you design focus groups for employee and stakeholder research?

Internal focus groups explore employee perspectives on customer experience delivery, organizational culture, and service improvement opportunities through discussions that reveal frontline insights and operational challenges. We examine how employee experience affects customer experience delivery, identifying organizational factors that support or hinder excellent customer relationships.

Tip: Include employee focus groups in customer experience research to understand how internal experience affects customer experience delivery quality.

What's your approach to focus group facility selection and environment design?

Environment design affects participant comfort and discussion quality through facility location, room setup, and atmosphere that encourages open sharing. We select facilities that are convenient for participants while providing appropriate technology, observation capabilities, and comfort amenities. Environment considerations include both physical space and psychological atmosphere that supports productive discussion.

Tip: Choose focus group facilities that feel comfortable and neutral rather than corporate or intimidating to encourage authentic participant sharing.

How do you handle virtual and remote focus group research?

Virtual focus groups use video conferencing technology that enables face-to-face interaction while accommodating geographic diversity and scheduling flexibility. We adapt moderation techniques for digital environments, including breakout room usage, screen sharing for concept testing, and digital collaboration tools. Virtual considerations include both technology requirements and engagement strategies for online environments.

Tip: Test virtual focus group technology and participant comfort with digital tools before research sessions to ensure smooth execution and maximum participation.

What's your approach to focus group recording and documentation?

Documentation involves audio and video recording with participant consent, systematic note-taking, and real-time observation capture that preserves both content and context of discussions. We create documentation approaches that enable detailed analysis while respecting participant privacy. Recording includes both technological capture and human observation that supplements recorded material.

Tip: Include multiple documentation methods in focus groups rather than relying solely on recording to capture non-verbal communication and group dynamics.

How do you manage focus group scheduling and participant coordination?

Scheduling coordination involves participant availability management, reminder systems, and backup planning that ensures adequate participation despite potential cancellations. We use systematic confirmation processes, incentive management, and flexible scheduling that accommodates participant needs while maintaining research timeline requirements. Coordination includes both logistical planning and participant relationship management.

Tip: Over-recruit focus group participants by 15-20% to account for last-minute cancellations rather than assuming all confirmed participants will attend.

What's your approach to focus group incentive and compensation strategies?

Incentive strategies balance participant appreciation with research integrity, providing appropriate compensation that respects participant time without creating bias toward positive feedback. We consider participant characteristics, session length, and research topic complexity when determining incentive levels. Compensation includes both monetary and non-monetary appreciation approaches.

Tip: Set focus group incentives at levels that show appreciation for participant time without creating bias toward telling researchers what they want to hear.

How do you handle no-shows and last-minute participant changes?

Contingency planning involves backup participant recruitment, flexible session management, and alternative discussion approaches that maintain research quality despite participant changes. We create protocols for minimum group sizes, replacement participant activation, and session adaptation that ensures productive research despite attendance variations.

Tip: Develop contingency plans for focus group attendance issues rather than hoping optimal attendance will occur naturally.

What's your approach to stakeholder observation and client involvement?

Stakeholder observation involves structured observation opportunities, real-time insight capture, and post-session debrief discussions that maximize client learning while maintaining participant comfort. We balance client involvement with research integrity, providing observation guidelines that enhance rather than interfere with discussion quality. Observation includes both live sessions and recorded review options.

Tip: Prepare stakeholder observers with guidelines about note-taking and reaction management to prevent client emotions from influencing focus group dynamics.

How do you integrate focus groups with survey research for comprehensive insights?

Integration involves using focus groups to explore attitudes and motivations that inform survey design, then using survey data to validate and quantify focus group insights across larger populations. We create sequential research approaches that leverage each method's strengths while addressing limitations. Integration includes both methodology design and insight synthesis across different data types.

Tip: Use focus group insights to inform survey question design rather than developing surveys and focus groups as separate activities to ensure research methods complement each other.

What's your approach to combining focus groups with individual interviews?

Method combination uses focus groups to understand social dynamics and shared perspectives while using individual interviews to explore personal experiences and sensitive topics that participants might not discuss in groups. We design research approaches that leverage group energy for concept exploration and individual depth for personal experience understanding.

Tip: Combine focus groups with individual interviews to understand both social influences and personal experiences rather than relying on either method alone.

How do you use focus groups to validate insights from observational research?

Validation involves presenting observational findings to focus groups for interpretation, explanation, and additional context that helps understand why observed behaviors occur. We use focus groups to explore motivations behind observed patterns and gather suggestions for experience improvements based on ethnographic insights. Validation includes both confirmation and explanation of observational findings.

Tip: Present observational research findings to focus groups for interpretation and explanation rather than just confirmation to understand customer motivations behind observed behaviors.

What's your approach to focus groups in design thinking and co-creation processes?

Co-creation focus groups involve participants in solution development through collaborative exercises, ideation sessions, and design feedback that goes beyond evaluation to active creation. We facilitate creative workshops that leverage group creativity while maintaining strategic focus on business objectives. Co-creation includes both problem exploration and solution generation activities.

Tip: Include creative materials and collaborative exercises in co-creation focus groups rather than just discussion to engage participants in active solution development.

How do you combine focus groups with analytics and behavioral data analysis?

Data integration involves using focus groups to explain patterns discovered in analytics data, exploring customer motivations behind observed behaviors and gathering suggestions for optimization based on quantitative findings. We combine qualitative insights with quantitative patterns to create complete understanding of customer experience. Integration includes both explanation and solution development based on data insights.

Tip: Present analytics findings to focus groups for interpretation and improvement suggestions rather than trying to explain data patterns without customer input.

What's your approach to focus groups in journey mapping and experience design?

Journey-focused groups contribute to experience mapping through story-sharing, emotion exploration, and touchpoint evaluation that reveals customer perspectives on experience connections and quality. We use focus groups to validate journey maps created through other methods and gather suggestions for journey improvements. Journey research includes both current experience exploration and ideal experience visioning.

Tip: Use focus groups to validate and enrich journey maps created through other research methods rather than trying to create complete journey maps through group discussions alone.

How do you integrate focus groups with usability testing and user research?

Integration involves using focus groups to explore attitudes and expectations that inform usability testing design, then using usability findings to guide follow-up focus group discussions about user experience improvements. We combine observational usability data with attitudinal focus group insights to understand both what happens and why it happens in user experiences.

Tip: Use focus groups to explore user attitudes and expectations that inform usability testing objectives rather than trying to test actual usability through group discussions.

How do you integrate AI and technology into focus group research processes?

AI enhances focus group research through automated transcription, sentiment analysis of discussions, and pattern identification across multiple sessions that reveals themes and insights human analysis might miss. We use AI for post-session analysis while maintaining human moderation and interpretation for strategic insights. AI integration includes both technological augmentation and ethical considerations that preserve participant privacy and research integrity.

Tip: Start AI integration with transcription and basic analysis rather than automated moderation to understand AI capabilities before expanding technology involvement in focus group research.

What's your approach to international and cross-cultural focus group research?

Cross-cultural research requires understanding communication styles, cultural values, and expression patterns that affect focus group dynamics and insights. We adapt moderation approaches, group composition, and discussion topics for different cultural contexts while maintaining research objectives. International research includes both local cultural adaptation and global insight synthesis.

Tip: Include cultural consultants in international focus group planning rather than just translating existing discussion guides to ensure cultural appropriateness and meaningful insights.

How do you design focus groups for emerging technology and innovation exploration?

Technology focus groups explore customer reactions to new concepts, usage scenarios, and adoption barriers through demonstration, scenario discussion, and hands-on exploration that reveals both excitement and concerns about innovation. We use foresight design principles to explore future customer needs and technology integration preferences.

Tip: Include hands-on technology exploration in innovation focus groups rather than just concept discussions to understand realistic customer reactions to new technologies.

What's your approach to focus groups for organizational change and transformation?

Change-focused groups explore stakeholder reactions to transformation initiatives, implementation concerns, and communication preferences that inform change management strategies. We examine both employee and customer perspectives on organizational changes, understanding impact on relationships and experience quality. Change research includes both current impact assessment and future adaptation planning.

Tip: Include both employee and customer focus groups in organizational change research to understand change impact on experience delivery from multiple perspectives.

How do you use focus groups for crisis preparation and response research?

Crisis preparation involves exploring customer expectations for crisis communication, service continuity, and recovery approaches through scenario-based discussions that reveal relationship priorities during difficult situations. We examine both immediate crisis response preferences and long-term trust rebuilding expectations. Crisis research includes both prevention planning and response strategy development.

Tip: Include crisis scenario planning in regular focus group research rather than waiting until actual crises to understand customer expectations and communication preferences.

What's your approach to focus groups for regulatory and compliance communication?

Compliance focus groups explore customer understanding of regulatory requirements, communication preferences for compliance information, and impact of regulations on customer experience through discussion of real scenarios and communication approaches. We examine how regulatory requirements affect customer relationships and identify communication strategies that maintain compliance while preserving experience quality.

Tip: Include customer perspectives in compliance communication development rather than just legal and regulatory viewpoints to ensure regulations are communicated effectively.

How do you design focus groups for sustainability and social responsibility research?

Sustainability focus groups explore customer values alignment, expectations for organizational responsibility, and preferences for sustainability communication through discussion of environmental and social impact scenarios. We examine how sustainability initiatives affect customer relationships and identify authentic communication approaches that build rather than undermine trust.

Tip: Explore customer values and expectations around sustainability in focus groups before developing sustainability communication to ensure authentic rather than performative messaging.

What's your collaborative approach to focus group research planning and execution?

Collaborative planning involves stakeholder workshops, objective setting sessions, and iterative discussion guide development that ensures research addresses real business needs while maintaining methodological rigor. We combine client business knowledge with research expertise to design focus groups that provide strategic value. Collaboration includes both research design and insight interpretation phases.

Tip: Include diverse internal stakeholders in focus group planning to ensure research objectives address multiple business perspectives and decision-making needs.

How do you handle focus group research project management and timeline coordination?

Project management includes recruitment coordination, facility booking, stakeholder scheduling, and contingency planning that ensures smooth research execution within business timeline requirements. We provide regular updates, milestone communication, and proactive issue resolution that keeps projects on track while maintaining research quality standards.

Tip: Build flexibility into focus group project timelines for potential recruitment challenges or scheduling conflicts rather than assuming optimal conditions will occur.

What's your approach to focus group insight interpretation and stakeholder alignment?

Insight interpretation involves collaborative analysis sessions where focus group findings meet business knowledge, using structured interpretation approaches that transform qualitative insights into strategic recommendations. We facilitate stakeholder workshops that ensure insights are understood and actionable rather than just documented. Interpretation includes both analytical rigor and business application guidance.

Tip: Include stakeholder interpretation sessions after focus groups rather than just delivering reports to ensure insights are understood and actionable within your organizational context.

How do you provide focus group research training and capability building?

Capability building includes training in focus group planning, moderation, and analysis that enables your organization to conduct effective group research independently. We provide methodology education, moderation skill development, and ongoing consultation that builds internal research capabilities while maintaining quality standards. Training includes both technical skills and strategic thinking development.

Tip: Include hands-on moderation practice in focus group training rather than just theoretical education to build practical skills for real research challenges.

What's your approach to long-term focus group research partnerships and programs?

Long-term partnerships focus on ongoing customer insight development rather than project-based research, providing systematic focus group programs that track customer attitude evolution and market changes. We develop research programs that adapt to changing business needs while maintaining longitudinal insight value. Partnership includes both strategic consultation and tactical research support.

Tip: Consider systematic focus group programs for ongoing customer insight rather than just project-based research to understand customer attitude evolution over time.

How do you ensure maximum value from focus group research investments?

Value maximization requires clear objectives, rigorous methodology, actionable insights, and implementation guidance that creates lasting competitive advantage. We focus on developing organizational capabilities and customer understanding that continues delivering value beyond immediate research completion. Investment value includes both strategic insights and capability development.

Tip: Include capability building and methodology transfer in focus group research projects to ensure investment value continues growing beyond immediate research insights.

What's your approach to focus group research quality assurance and ethical standards?

Quality assurance includes methodology validation, participant protection, and insight verification that ensures research findings are both reliable and ethically obtained. We use systematic quality checks throughout the research process while maintaining participant confidentiality and informed consent. Ethical standards include both research integrity and participant respect throughout the process.

Tip: Include independent quality review of focus group methodology and ethical standards rather than relying solely on internal validation to ensure research credibility and participant protection.