A Revolutionary Insurance Experience? – Part One

The insurance experience.

It’s not something that gets people excited. Not much has changed in the last several years and many customers view the entire thing as in the same category as taxes: a mandatory chore.

However, there have been two companies recently that have promised something different.

First, there’s Lemonade, a company in the United States that proudly proclaims, “forget everything you know about insurance”. This company is slowly rolling out to different states and has been built off of the concept of automating the insurance experience so that it is easy and fast for customers.

Next, there’s Sonnet, a Canadian company with a website that declares, “insurance has changed”. Like Lemonade, this company also is trying to make the insurance experience easier and faster through automation.

These sites make some big promises, but how do their initial experiences stack up?

For part one in this series, we will be reviewing Lemonade’s initial experience. To read the review for Sonnet’s experience go check out part two!

—

Initial Research

The first stage we go through with a company is determining if they have what we need. For both Lemonade and Sonnet, we’ll be looking at the experience of getting home insurance. So first, before we delve into how much something costs let’s see what they even have. We’ll be trying to answer the basic question of what kind of coverage does this insurance company offer?

This is the main page for Lemonade’s website. You can clearly see where you can check prices, but it’s less clear where you can find out more about what will be covered.

Scroll a bit further down on the page and you will see this image. Should I infer from this picture that they will cover my electronics for thefts and floods? What about fire? Goodbye couch and TV stand. It doesn’t look like they are covered in this image.

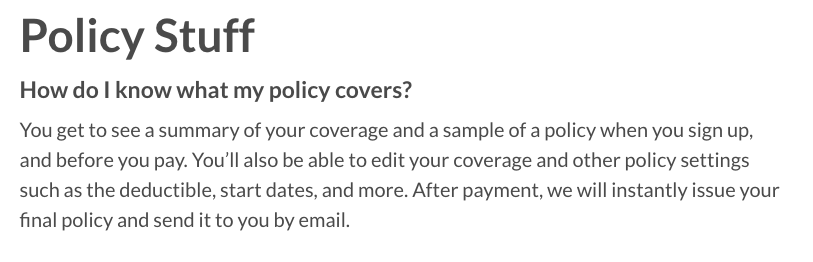

You can keep scrolling to the end of the main page, but there is no information about the coverage that they provide. If you keep looking through all the pages on the website you will eventually find that in the FAQ Lemonade has this to say about their coverage:

So, it’s only right before you pay that you’ll actually find out more about what they cover. You have to go through the whole process before finding out basic coverage information.

So far, it has not an easy and fast process with Lemonade. Hopefully, their quoting experience will be far more impressive as we’ll have to go through the whole thing to find out what they even cover.

—

Getting a Quote

Let’s move onto the next stage of our initial experience with Lemonade, getting a quote. In this stage, we’re looking at the question of how much is this going to cost me?

Right after we click to get a quote, we are introduced to Maya, told that we can get a good quote in seconds, and asked for a name.

Interactions like this always bug me. I know I’m not talking to a real human, why are we trying to pretend that I’m talking to someone named Maya? It doesn’t feel any more personal. It’s also a little weird to have a chatbot when we are never actually chatting. The entire interaction is just filling out fields.

Setting aside the bot thing, this form is easy to complete and it’s clear how to move to the next step. The only problem is that homeowner’s insurance is often purchased with two people on the policy. It’s unclear at this stage if you will be able to add a second person at a later stage.

Side note: I timed myself going through this and it actually took about four minutes to get a quote (and that was without looking at the terms and conditions which I would normally at least skim through). Is that still considered seconds?

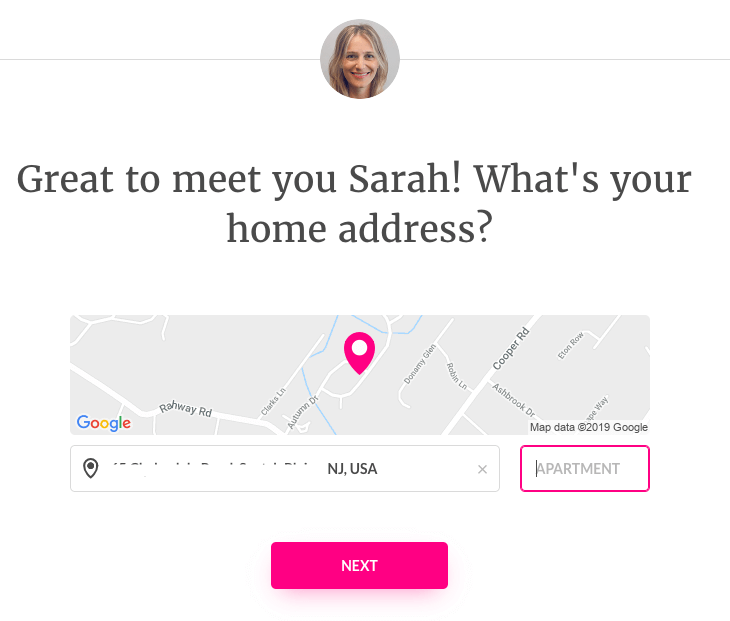

The next step is where you are asked to put in your address. This works pretty well and will suggest addresses as you type. Once you’ve put in an address, it shows you a map view to confirm.

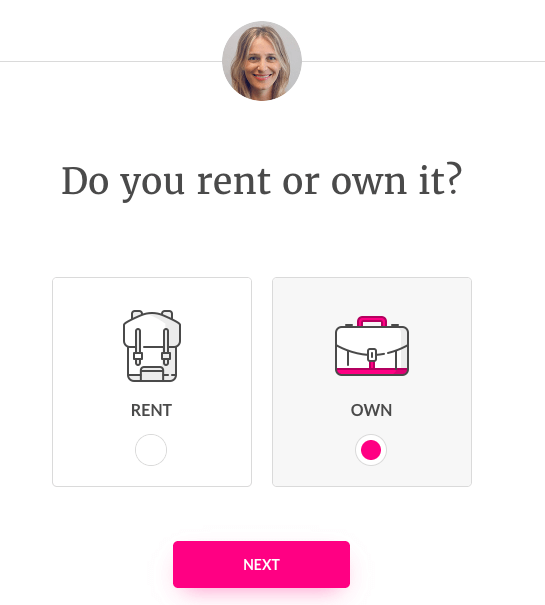

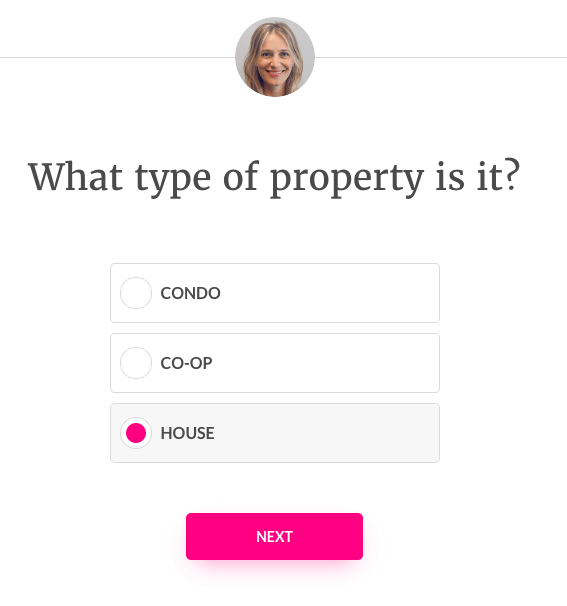

Then you answer some basic questions about your house. These questions are very simple and don’t need anything beyond a basic understanding to complete.

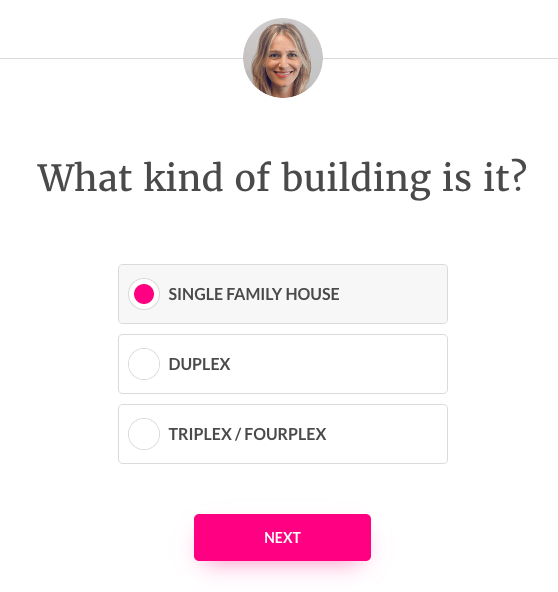

This next question, however, gets a little more complicated. The terms ‘Single Family House’ ‘Duplex’, ‘Triplex’ and ‘Fourplex’ are not familiar words to everyone and their definitions change depending on the region.

If you live in a row of townhomes but have only one family in your home, what kind of building is that? If you have a detached house but have two families living there, what kind of building is that?

Providing a little bit of “helper text” here would enable people to figure out the right selection without resorting to Google or possibly selecting the wrong option.

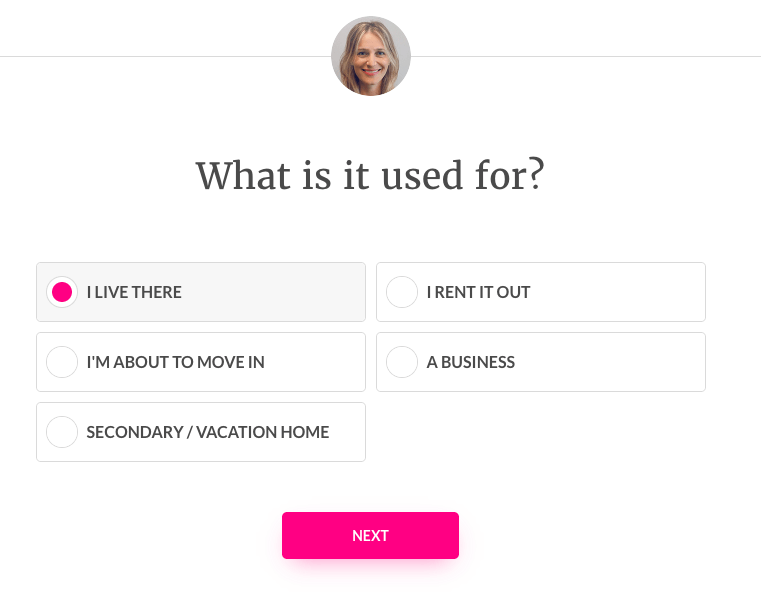

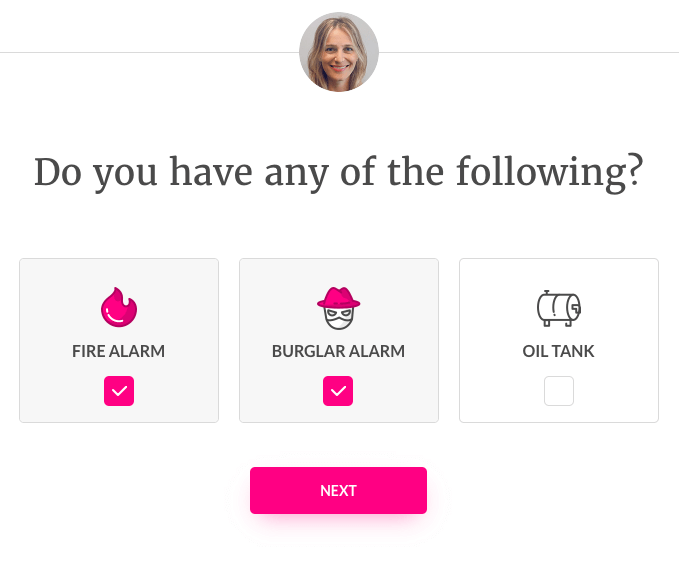

Next, you fill in some more questions about your house. The second question provides some icons to help make the oil tank a bit clearer. It’s a lot easier to know that you don’t have one when you know what it looks like.

The next question is clear, but it comes a little out of left-field. Encountering a question about whether you have a dog when looking for home insurance isn’t exactly typical. It’s unclear if this is a question that is going to be negatively affecting your rate or if they are going to be offering you another insurance product or features.

The next question about expensive possessions also doesn’t have an explanation but makes more sense than the previous question. It’s more common to see questions about jewelry in other home insurance quoters. Even though this type of question is more common, it would be nice to know if this is affecting my rate or I am just being offered new products.

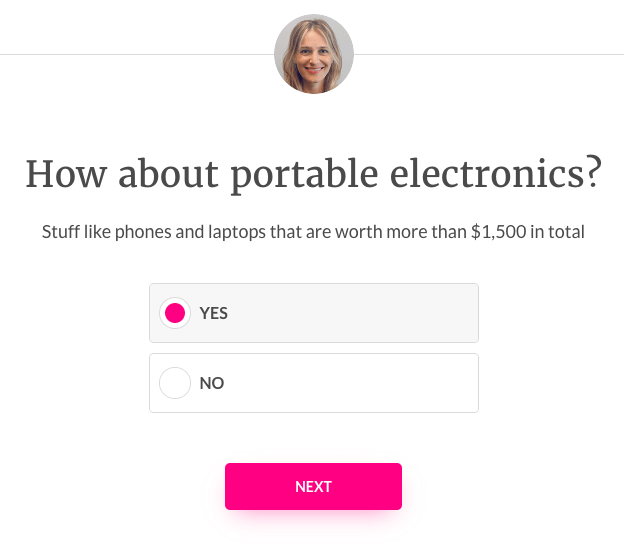

The next question about the electronics is the first question in the quoter where the customer has been provided with some information about what to do. Giving examples here is very helpful as the term ‘portable electronics’ isn’t a commonly used phrase.

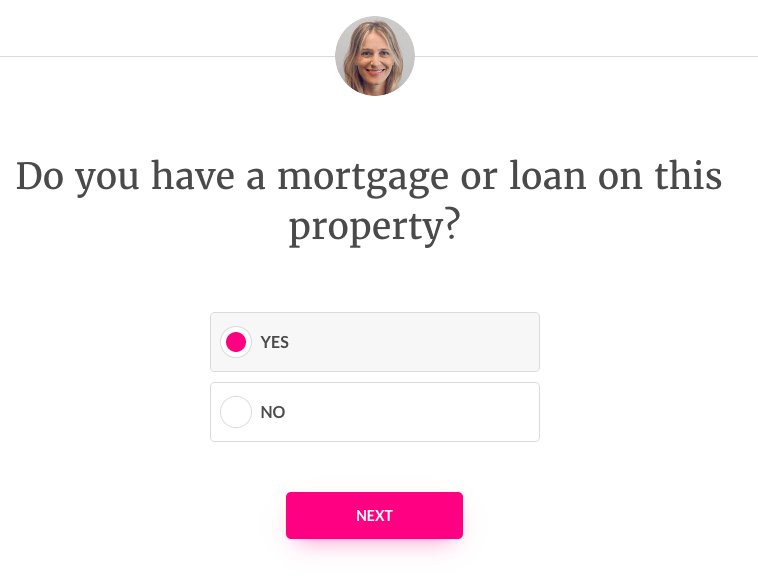

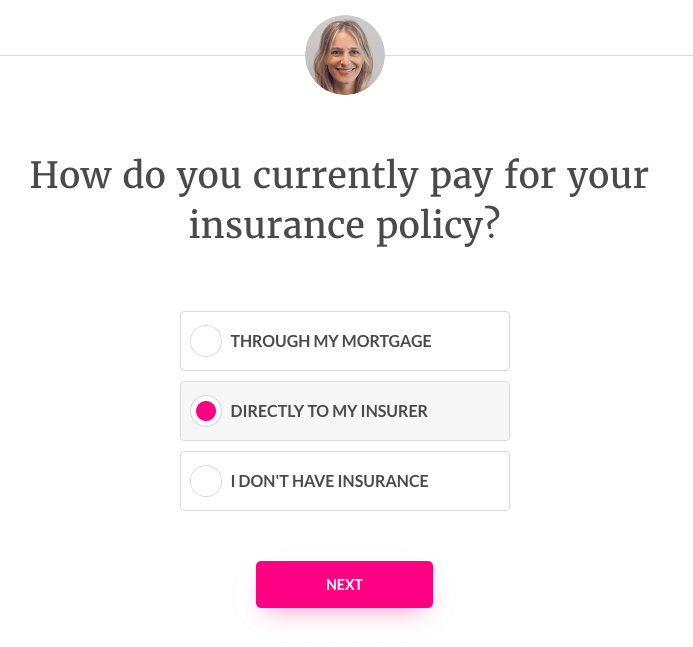

Next you are asked two more questions that as a homeowner would be easy enough to answer. The only thing that is missing from here again is why I am being asked for this information. As you answer the questions, you’re just left with assuming that this information is somehow needed to calculate a quote.

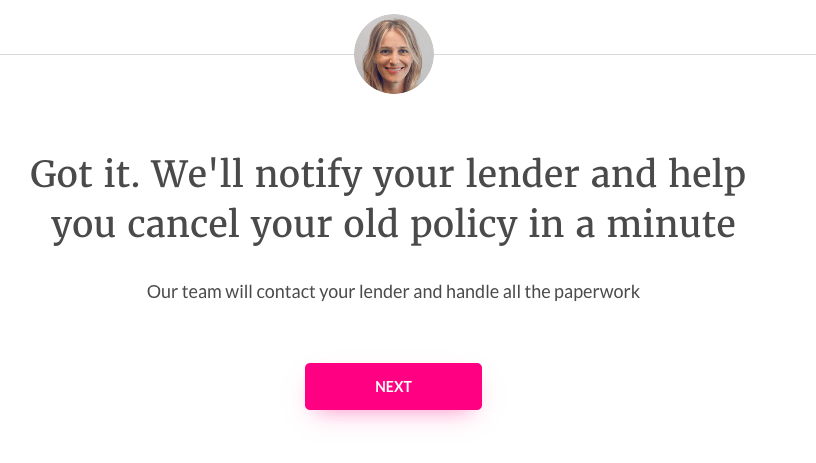

Woah, wait. I’m not ready to cancel my old policy. I don’t know anything about this new service. I don’t know what it costs and I don’t even know what it covers.

This feels very sudden and is coming at a point in the process where I’m not even thinking about the logistics of switching. It’s unclear what will happen if I click next from this page. Will my old insurance be cancelled? There is no indication on this screen about where we are in the process and what is happening next.

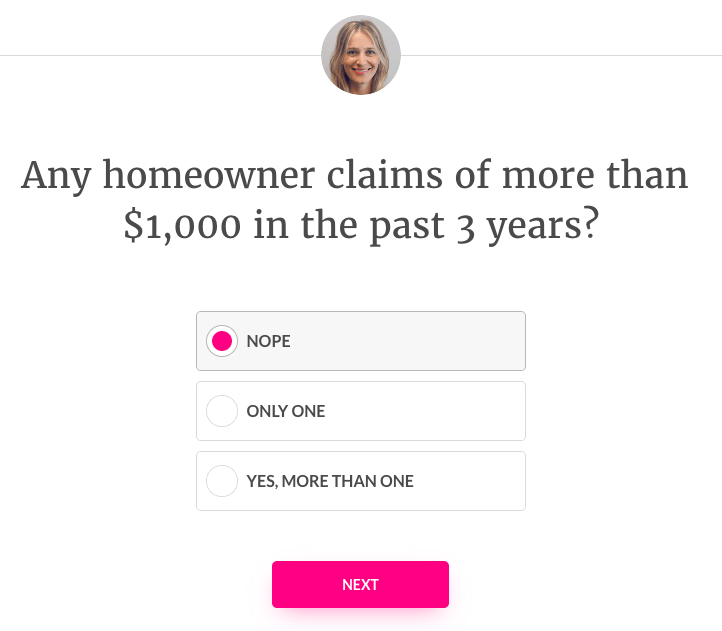

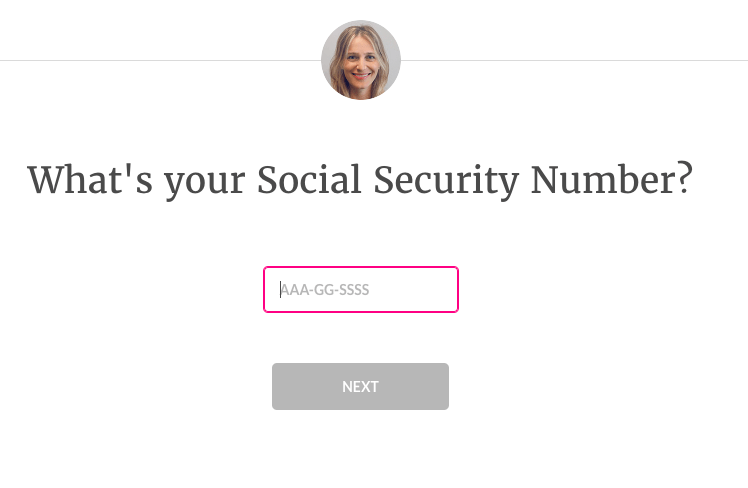

Well, guess my insurance hasn’t been cancelled yet, which is a good thing. This question is again fairly straightforward and should be a quick one to answer, but at this point you’re starting to wonder when these questions will end. There’s no status bar to show us that we are halfway done or no broad steps to indicate that we are now in step 3 of 4. These questions could go on forever for all I know.

Wow. For a lot of insurance companies, this information is optional in the quoting experience and you can see why. In the age of constant information leaks, I’m not about to go throwing away this incredibly personal information when I have been given no information from Lemonade yet.

Maya’s creepily smiling face doesn’t make me any more willing to give this up. There is nothing about this page that looks trustworthy. There is no information about what this will be used for, how it will be kept secure, and when the data will be destroyed. There is also no option to skip this.

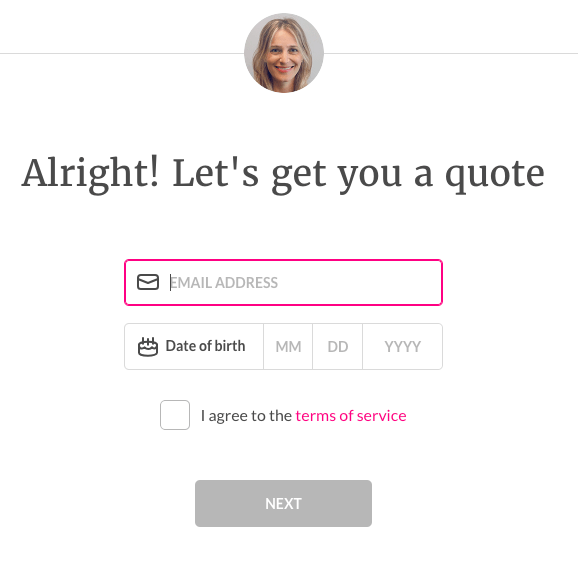

Hooray! Looks like I’m finally ready to get a quote. Except -? I really don’t want to give you my email address. I’m just looking for a price and some more information about your coverage. I don’t want to be spammed for the next few months and have to go through some unsubscribe process to get rid of the emails.

Also, why do I have to agree to terms of service to get a quote? This entire process has felt more like I am buying the thing than just checking it out.

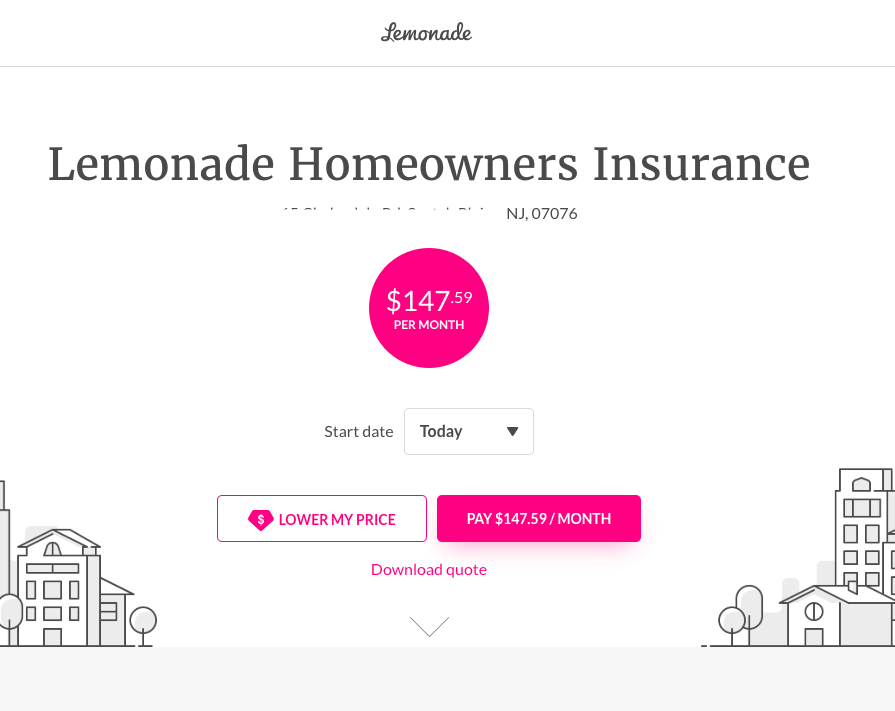

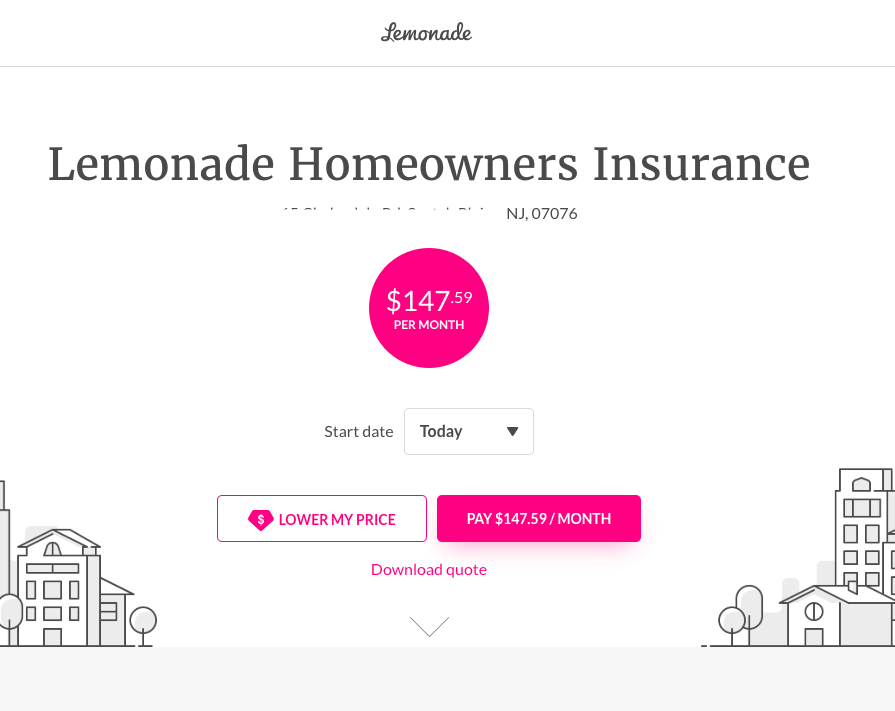

And here it is, my quote!

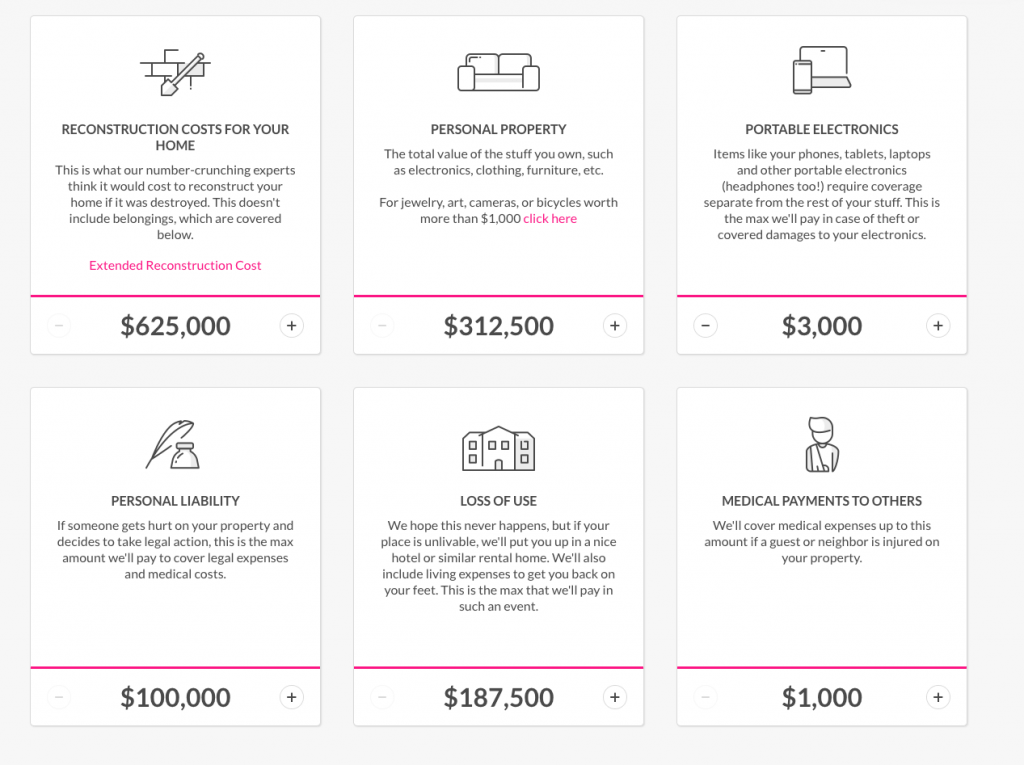

This page is clearly laid out and I can see how much I would pay a month. The option to download the quote is a nice feature. If I keep scrolling down, then I can finally see more details about the coverage. This information is again pretty clearly laid out.

There’s a good description around each of the coverage items to let me know a bit about what is covered and what it means. You can adjust the amount of coverage below. It would be nice if they provided some resources to help you make a decision around the level of coverage you might need, but this is already pretty good compared to many other insurance companies.

Adjusting the coverage automatically updates the monthly cost in real time so you can see how different levels of coverage affect price.

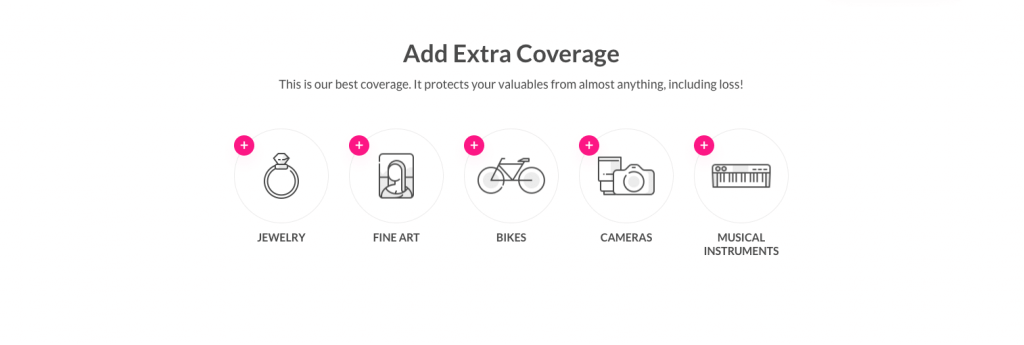

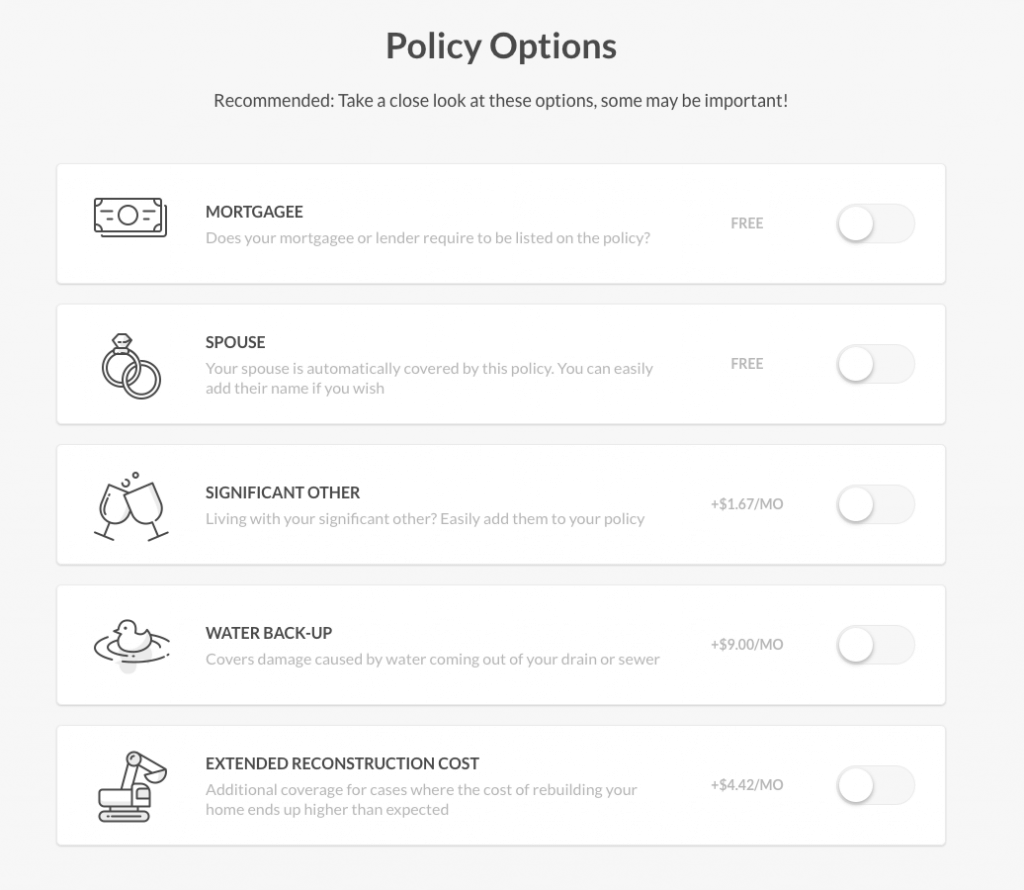

If you keep scrolling you will see that you are able to add different types of special insurance to your policy for expensive belongings and that you are able to adjust some policy options.

This might just be because I am Canadian, but it is not clear to me whether I should check spouse or significant other for a common law partner. It seems very strange to pay an extra $1.67 a month for a common law partner so I imagine that you would select spouse? This isn’t clear though.

Now, what’s that option at the very top that says ‘lower my price’ do?

Well. It’s another quoter.

Welcome back, Maya. Looks like Lemonade removed some questions from their initial quoter experience and added them to a secret second quoter experience.

Not so sure how I feel about that. It either seems like Lemonade is trying to artificially lower the number of questions in your initial experience to make it seem shorter or that they are trying to trick people into paying more when they qualified for discounts by hiding it on the end result page.

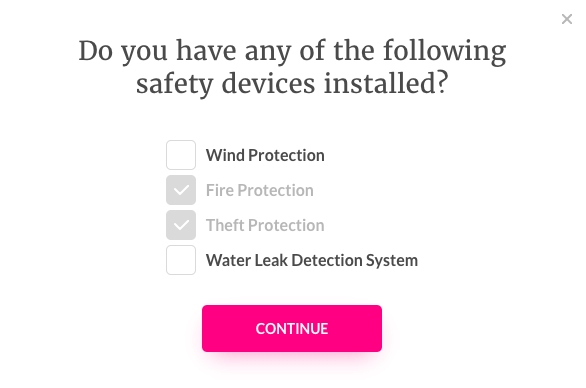

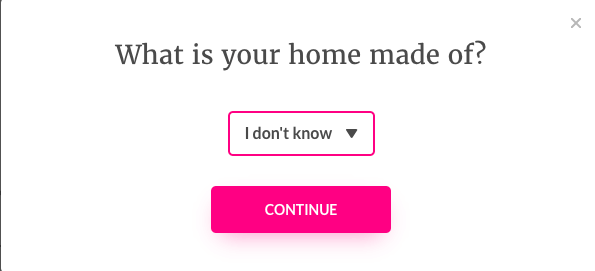

This second quoter follows pretty much the same format as the first with a series of questions about your house.

Again, some of these questions could benefit from explanations. What is wind protection? Is this a particular device or is this if my windows have shutters?

After filling out the second quoter questions, I was presented with information about how my monthly price had gone down. The updated price was very clear and if you click to download your quote you can see what discounts have been applied.

Final Verdict

Lemonade Insurance -? Mostly Bitter, Not So Sweet

Lemonade Insurance had a good idea. They just executed it in a totally haphazard unpolished way. It feels like the entire concept behind it was “Let’s use a chat bot style! Those are cool. And we’ll add emojis to make it fun and hip”. It feels less like it was designed as a cohesive piece and more like it was cobbled together based on things that needed to go in there and random ideas people had.

The quoter and the website could really benefit from thinking about the process from a customer’s perspective and the journey of buying insurance rather than from a company perspective. The order of things feels disjointed and confusing, and many things could be more clearly explained then they are now.

Lemonade does do many things better than other insurance companies in the US, but frankly, that’s not very hard.

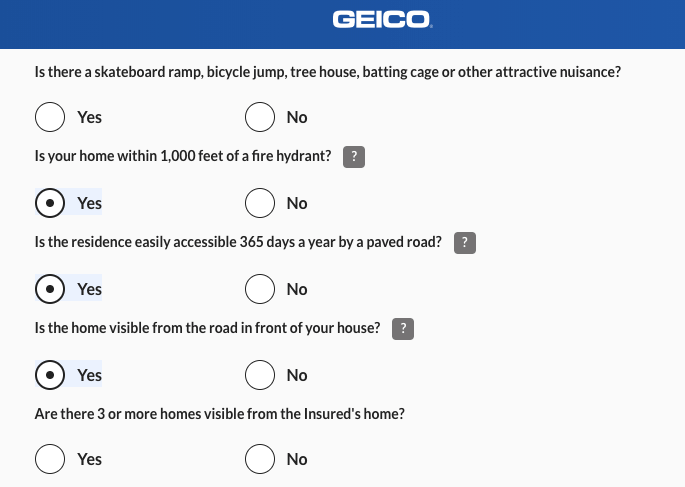

Typical neighbour one: I’m just building an attractive nuisance in my backyard.

Typical neighbour two: Oh yeah? What is it? A pool? A jungle gym?

What I’m expecting from Lemonade is not to do a little bit better than the other companies but rather to rethink the insurance experience and completely redesign it with customers in mind.

They have a really great premise and an interesting new idea, but they haven’t quite taken it to completion.

Lemonade, if you’re reading this, you deserve a better execution of your idea. I appreciate your efforts to improve a stagnant industry, but I know you could make something far greater than this.

Comments

Related Articles