A Revolutionary Insurance Experience: How do Lemonade and Sonnet Stack Up? – Part Two

Some insurance companies are trying to rewrite the insurance experience, but how well do they deliver on their promises?

In part one we reviewed Lemonade insurance, an American company that is building momentum and trying to create a better experience.

For the second instalment of the insurance experience review, we’ll be taking a closer look at Sonnet, a Canadian company that is also trying to deliver something different. We’ll observe two aspects of Sonnet’s insurance experience: the initial research and the quoting process.

Initial Research

This is the first stage people go through when they are looking for insurance. “What options are out there that fit my needs?” For both Lemonade and Sonnet, we’re looking at the experience of getting home insurance. Before we delve into how much something costs, let’s see what the two insurance companies offer. We’ll be trying to answer the basic question of: “what kind of coverage does this insurance company offer?”

This is the homepage of Sonnet’s website. From here, if you scroll past the main ‘Get a Quote’ section you can see where to click to learn more about the type of insurance you’re interested in.

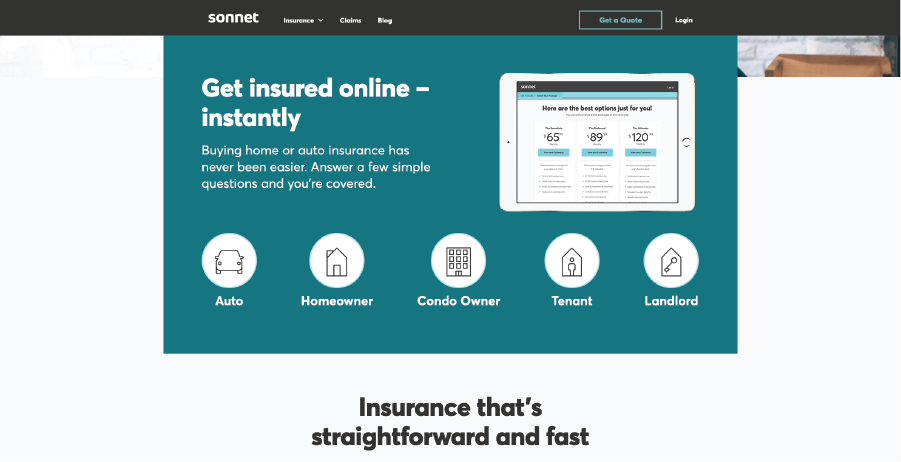

Once you click on one of the five situations that best fits your needs, you’re brought to a page about each type of insurance and what is offered.

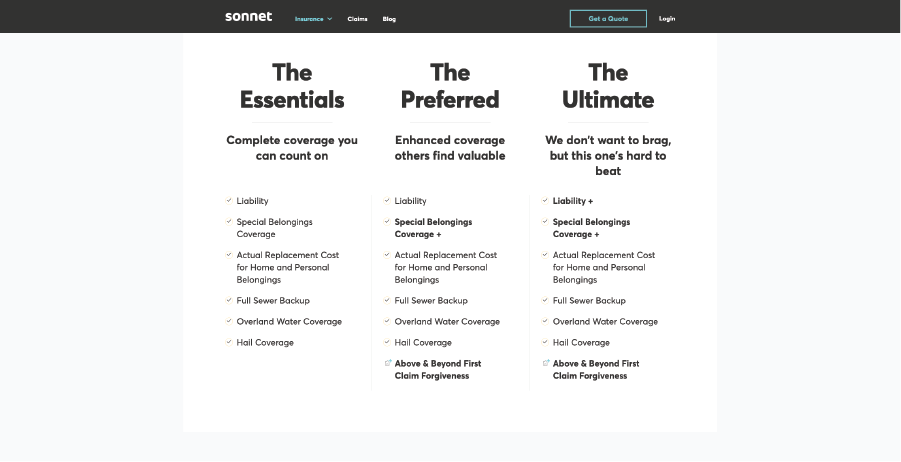

The Home Insurance page gives you a simple overview of the different levels of insurance they offer. From here you can also download a sample home policy to see what it might look like.

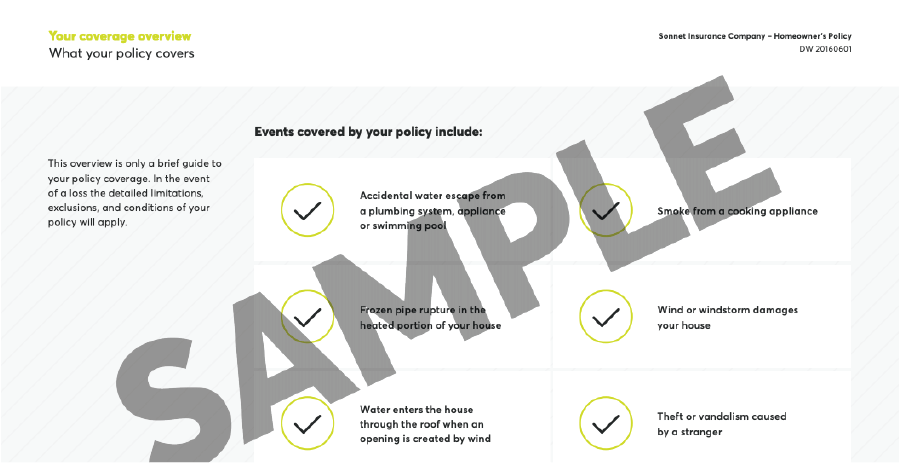

The evidently fast and easy philosophy was even applied to this sample policy. Sonnet has included sections in the policy to spell out in common language what you are covered for.

For this first stage, Sonnet is clearly going above and beyond most insurance companies. Not only is information presented up front, it is presented in clear language with examples.

Assuming that their coverage information looks like it would work for you, you would now be ready to move onto finding how much it would cost.

Getting a Quote

In this next stage our main goal is to find out how much getting insured with this company would cost.

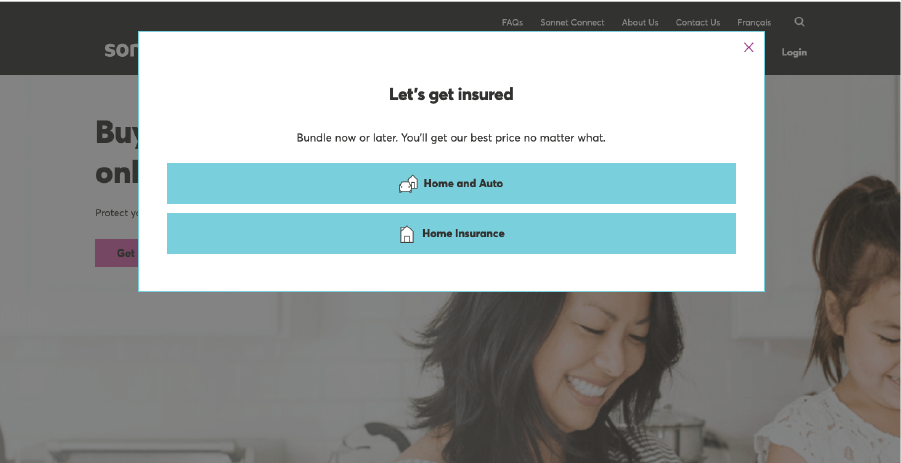

If you click on the ‘Get a Quote’ button on the Home Insurance page, you are presented with this pop-up:

In this instance, it’s clear that ‘Home Insurance’ should be clicked on. However, as seen on the website’s homepage, people often think of themselves as a ‘Condo Owner’, ‘Tenant’, or ‘Landlord’. Is ‘Home Insurance’ the obvious thing to click on in these situations? Sticking to the original labels that Sonnet used would have made it clearer that you were selecting the right option and that you aren’t accidentally signing up for something different.

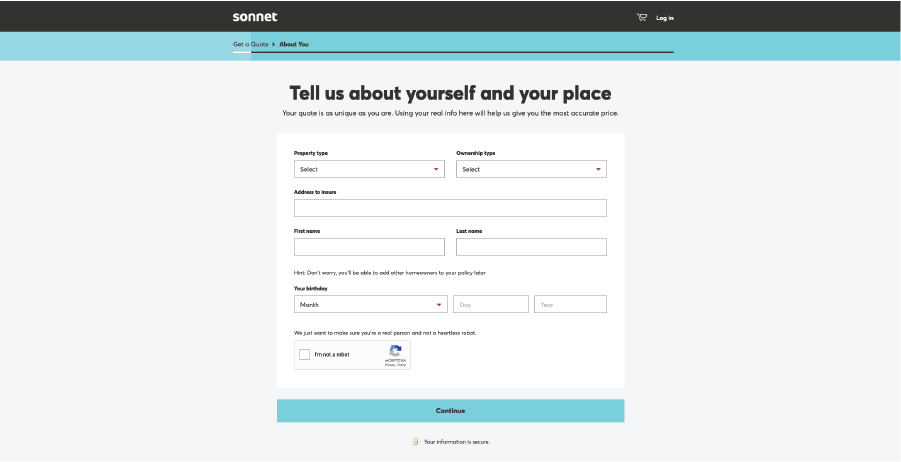

After selecting the Home Insurance option, you are asked to fill in some personal details. This form is simple to fill out and it’s pleasing to see that they didn’t use a dropdown to select your birth year or a calendar selector. This is something that websites often get wrong.

Another nice thing about this page is that there is a progress bar at the top to let you know how much further you have to go before getting your quote. It’s not entirely clear how many steps there are along the bar, but it at least feels like you’re moving.

The first two dropdown boxes on this page clear up the question of whether ‘Tenant’, ‘Landlord’ and ‘Condo Owner’ belong in this option, but you need to select ‘Home Insurance’ to know this is the right option for you.

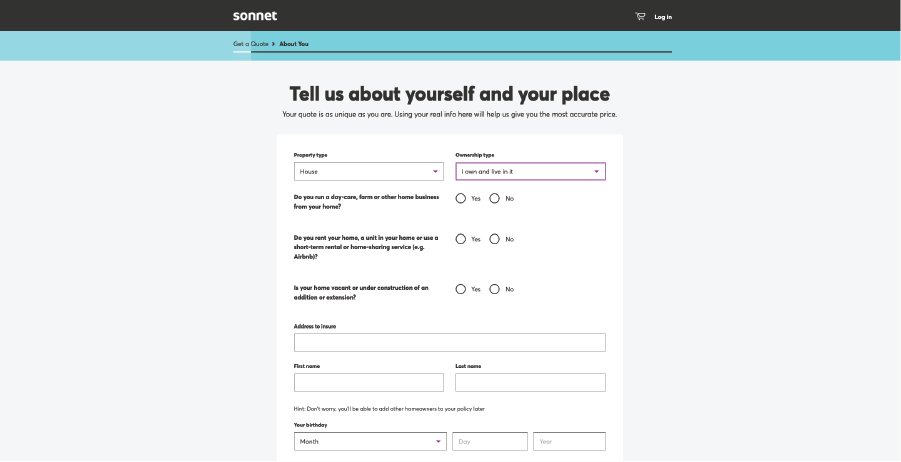

As you complete the first page, more questions are disclosed depending on what you select. A few options could provide a little more in the way of examples and details (a daycare and a farm are pretty intense — does writing books qualify as a home business?). In general, what to fill out is quite clear.

After you complete the first page, you then need to click ‘continue’ to move along to the next step in the quoting process.

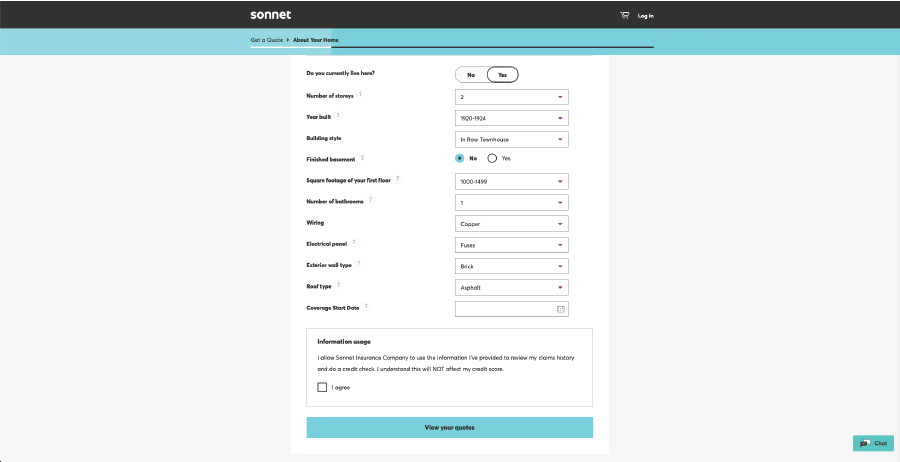

When you arrive at the next page most of your address’ information has been pre-populated for you. The information presented is sufficient for the few addresses tested, and it helps speed up completion of this page, which is a nice touch.

The majority of questions on this page are clear and there is informative text provided to let you know what is meant by each term -? except for oil tanks. Why are oil tanks excluded? This option could have benefited from a little explanation.

If you click on ‘view your quotes’ you’re taken straight to the numbers.

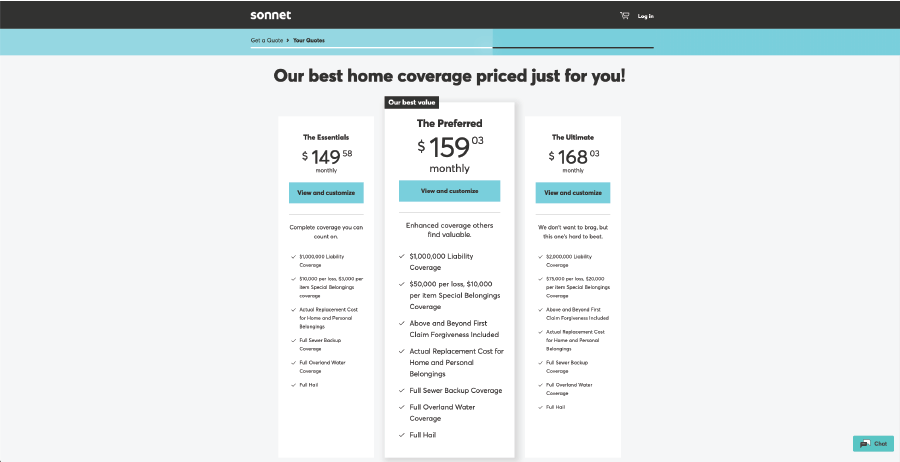

And just like that you have your quote.

Thinking back to our Lemonade review, there are way less hurdles to jump through to get a number with Sonnet. They didn’t need a social insurance number or even an email address. Their process was far simpler in comparison.

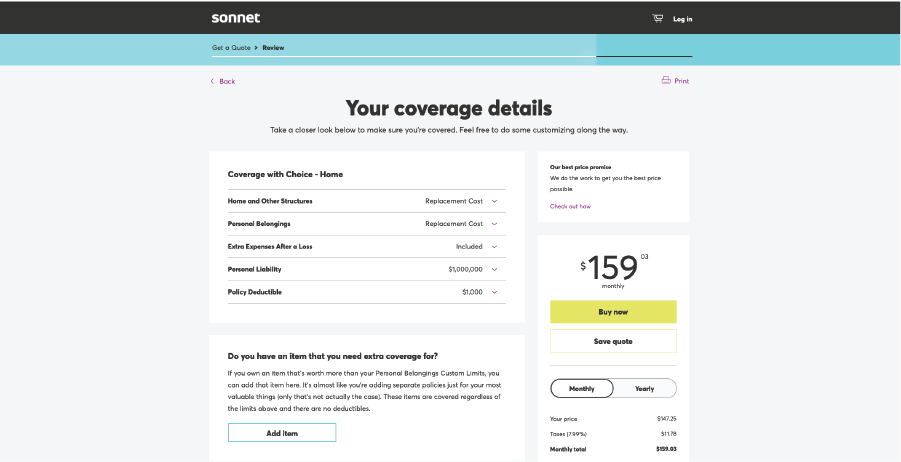

Presented are three options in the typical format of ‘good’, ‘better’, ‘best’ and there is a brief summary of the coverage to help in deciding between the three. After clicking on an option, you can view more information about the level of coverage and the option to tweak it for your situation.

Each coverage item is explained in plain language, so you understand what it means. You can change these options and see how each option affects your price in real-time. Once you’re done and have the level of coverage you think you need, you can either save the quote to come back later or purchase it immediately.

At the very bottom of the page there is a message to call them if you need coverage options that aren’t displayed here. This is good as it gives you an option if you are in a niche situation to ask questions or to try to get the coverage you need. This is pretty standard with insurance companies and isn’t really Sonnet going above and beyond here-?we’re noting it as Lemonade doesn’t provide this option.

Final Verdict

Sonnet Insurance -? Different in a Good Way

Sonnet’s website and quoting experience is impressive. It feels more thought-out and simpler than other insurance companies whose information is often hidden or presented in a way that you would need a law degree to understand. Sonnet provides examples and asks you for as little information as they need to get you a number, delivering on their homepage promises.

Comparing Lemonade to Sonnet is like looking at a prototype versus a polished product. Lemonade had a basic idea of something revolutionary and has started to get there, but Sonnet has already arrived. While there are a few things that Sonnet could improve and refine, they are more advanced than most companies with their online experience.

Hey insurance industry, the bar for your websites has just been raised.

Comments

Related Articles