An (Unintended) Exploration of Tax Software Usability

I had the questionable joy this year of trying out, not one, not two, but three tax return applications online to file my Canadian taxes. This is not because I really like filling taxes, but rather, it took me that long to find a good application.

Now, in years previous I’d always happily and easily submitted my taxes in February and never given it a second thought. However, this year was different, this year my taxes suddenly got complicated.

When I went to fill out my taxes with TurboTax, as I had done in years previous, it wasn’t as easy as I remembered. I wasn’t sure where to put information or what I needed to provide and the system wasn’t giving me with any informative responses. I had no idea what to do with some of the tax slips I had been sent in the mail and a bit of googling didn’t yield much either. Trying to fit the slips I had been given to the handholding wizard was leaving me frustrated and annoyed.

After filling everything in as best I could, I was presented with a number that didn’t make sense. It seemed very odd that I owed the government money when I still had a ton of tuition credits. Was TurboTax not using them? Did I have to check some box to tell it to use them? I fiddled some more, trying to find something wrong with what I had done. I fiddled a lot more; I fiddled three days more.

At this point, I was done with TurboTax. I didn’t know what was wrong and I had no idea how to fix it.

I decided to move on. There had to be another program that would help me file my taxes for free and it didn’t take long to find one. H&R Block started off promising. I was full of hope as I filled in all the basic information again. However, I quickly began to realize that this was just as confusing as the first one, perhaps even more so. I again filled everything in as best I could and when I got to the end was presented with another return number. This time, the government owed me money. Now that was concerning! I received a very different return number than the first program and it still wasn’t the ‘$0’ I was expecting. Which one was right? Were they both wrong?

What was going on?

Back to googling, back to trying to figure out what was actually going on in this new program. In frustration, I thought about filling everything out by hand on paper so that I could actually understand what was going on, but I recalled that being really tedious, even for a simple application.

As my desperation grew and the deadline loomed I considered just hiring someone to fill out my taxes. However, all hope was not lost. As a last resort I went to Revenue Canada’s website and found a list of approved tax filing programs. As I skimmed the list of software, I saw a name that caught my eye: SimpleTax. That sounded… simple. I checked out their website. It was free. I was willing to give it a final shot.

From the start SimpleTax was different. The other two programs I had tried so far both had a wizard-like interface to completing taxes. Both these programs distanced you from the forms and had you answer a series of questions. SimpleTax was not a linear guided process and kept the concept of tax forms.

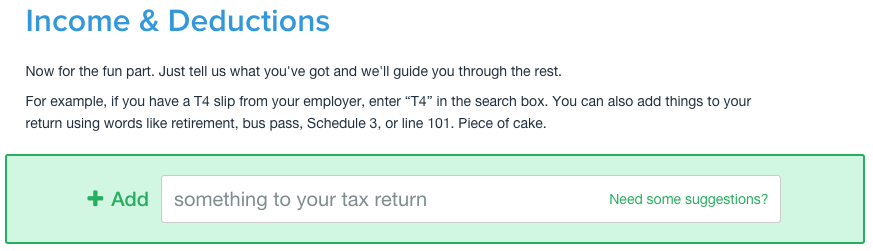

The major component of SimpleTax’s interface consists of this box.

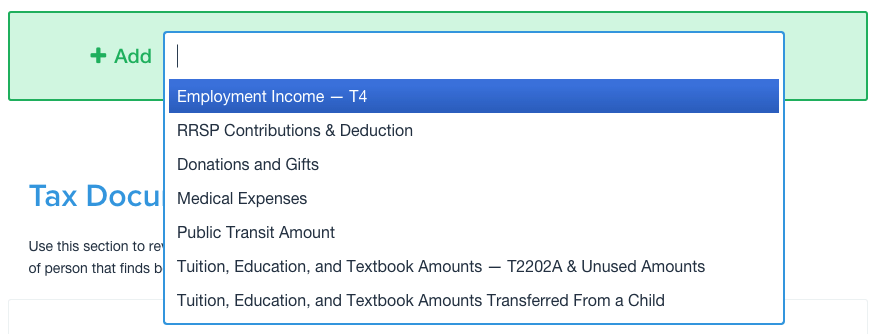

You can just type in the name of each of the slips you got in the mail and add them to your tax application. As soon as you click to type something into this box, a list of suggestions comes up.

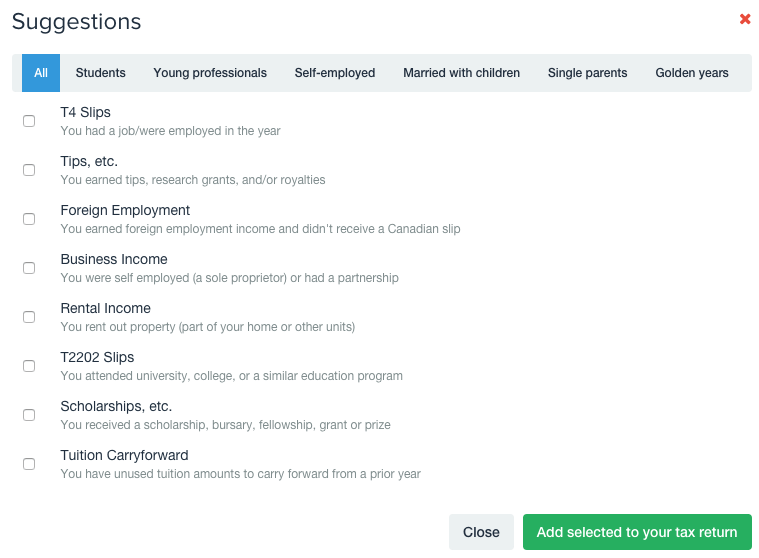

Looking at these suggestions, it seems like it could be a list of most frequently used forms. This saves the user typing to find these forms and also serves as a reminder of some frequent form that they might be forgetting. In addition to these suggestions, you can click on “Need some suggestions?†in the first box to bring up a longer list of suggestions by life situation.

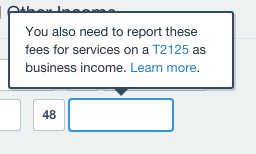

Where this program really shines though, is in informing you about connected forms. This is something that the previous two programs did not inform you about and they really should have. Say you received a T4A slip that had a number in box 48 and you needed to report it, in the other two programs, you can type your number in and carry on without ever being prompted to do anything else. In this program however, if you click to type your number in the box, you receive a message.

SimpleTax will tell you about any other forms that need to be filled out based on individual boxes you have completed. It gives you information about how these forms are connected and offers you further guidance through the process.

Most importantly though, SimpleTax is transparent about what it is doing. With the previous two programs there was no way to tell where numbers were coming from and if they were correct. In this program you can view everything that SimpleTax has filled into the governmental forms and see where the numbers are coming from. This level of transparency was sorely missing from the other two programs.

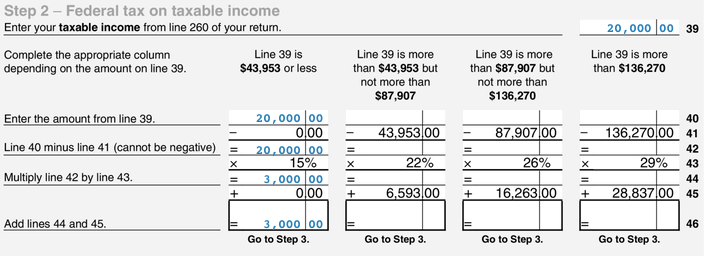

By clicking “Show document†above, the completed tax form will be displayed so that you can see exactly where each number is coming from.

Using this form, I was able to see that I was unable to use my tuition credits on the money I owed because it could not apply to that amount. This transparency allowed me to verify that the calculated amounts were correct and that I was ready to submit my forms.

Making forms simple doesn’t mean hiding everything from the user. The first two programs probably work well in simple tax cases, however, as soon as taxes get more complicated, people want to have some understanding of where their money is going and why, especially if there are large sums of money involved. If numbers aren’t aligning with people’s expectations, people immediately seek more explanation and if this isn’t readily available, they will look elsewhere.

In summary, the transparency provided in SimpleTax, puts it heads and shoulders above the other two programs I tried and will be my first choice come next tax year.

Comments

Related Articles

Thanks for the info. Very helpful.